by Dermot Cole

Attorney General Kevin Clarkson appears to be taking lessons from Bill Clinton’s—“It depends upon what the meaning of the word is, is”—handbook of political babble.

Clarkson signed off on a ballot summary for the proposed oil tax initiative that is so misleading that it appears designed to force a court fight, create confusion and build support for future oil industry talking points about the Fair Share Act.

Time is an issue because if the more than 28,000 signatures are not gathered before the start of the 2020 legislative session, the initiative will not make it onto the 2020 ballot next fall.

The Dunleavy administration does not want to see a vote on this measure. In fact, Gov. Mike Dunleavy and Clarkson would prefer a constitutional amendment that would strip voters of the power to enact taxes by initiative.

“So for industry, we want predictability for them so that they can come and invest in Alaska without having to worry about the risk that Alaska will continue to spend like crazy and then decide to pay for that spending through a predatory tax on industry,” Clarkson said during the Koch/Dunleavy budget road show last spring.

With the initiative moving ahead, Clarkson has signed off on some preposterous claims.

For one, the state’s top lawyer claims no one in the department of law can define “field,” as in Prudhoe Bay oil field. Hint: It’s not a force field, a baseball field or an empty field.

According to the AG’s office, the initiative is baffling because it uses “new terms such as ‘field’ and ‘units,’ currently not used in the tax code,” a comment that ought to be followed by a confession that Clarkson is channeling Unfrozen Caveman Lawyer: “I’m just a caveman, your world frightens and confuses me.”

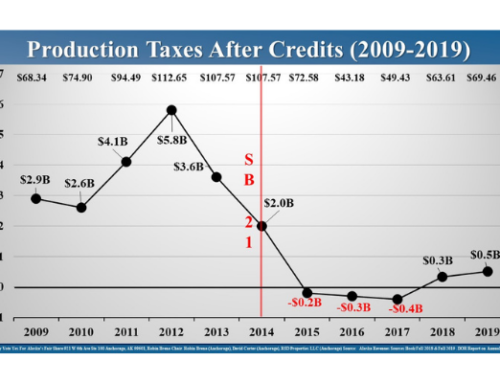

The tax increase proposed in the initiative would apply to the Prudhoe Bay, Kuparuk and Alpine oil fields, all of which have a long track record of production and are the most profitable parts of the North Slope.

Instead of debating the meaning of “is,” the Clintonesque Clarkson wants to say a lot depends upon what the meaning of the word “and” is.

The three fields mentioned above are the only ones that produced more than 40,000 barrels a day in the last calendar year and have each topped 400 million barrels of total production. Other North Slope fields would not face a higher tax under the initiative.

But according to the attorney general, it is not clear if the tax change “would apply to oil meeting one or both of the above production thresholds.”

He’s wrong. The initiative says that both thresholds have to be met.

With Clarkson creating confusion, look for the oil industry to build on this opening with a scare tactic—Clarkson will be identified as the source in state government who says the tax might apply to new, smaller fields that have yet to hit 400 million barrels, thus endangering an increase in oil production on the North Slope.

The initiative says the tax only applies to fields “that have produced in excess of 40,000 barrels of oil per day in the previous calendar year and in excess of 400,000,000 barrels of total cumulative oil production.”

The language is clear. The word “and” does not mean “or.” No one who understands English should believe Clarkson’s claim that the voter summary should say “40,000 and/or 400 million,” as is likely.

Clarkson also claims that a provision in the initiative that says oil tax documents would be a “public record” actually means the records would not be public records. That misrepresentation may be followed by oil company claims saying the measure would not lead to greater transparency.

Finally, state lawyers claim they don’t understand the use of the word “additional” when applied to the new tax in the initiative, though it is clear from the context that this is an amendment to the existing net profits tax law. Additional is the right word.

Alaskans may need to turn to the courts to declare that everyone knows what “field” means, that public records are public records, that “and” is not the same as “or,” and that this would be an additional tax on the most profitable and oldest North Slope oil fields.