(THE FAIR SHARE ACT)

Ballot Measure 1 (the Fair Share Act) will amend the current and failed production tax system enacted through Senate Bill 21 (SB21). The Fair Share Act will transparently increase Alaskans’ share from the sale of our oil on average by $1.1 billion per year. Each of the major sections of the Fair Share Act are explained below in light of the policies each major section was intended to achieve. Following this detailed sectional analysis is detailed modeling illustrating the manner in which the Fair Share Act is intended to be applied.

Aside from this statement, the sponsors would direct the reader to the web page for the sponsor that has additional materials important to the proper understanding of the Fair Share Act. That web site may be found at alaskasfairshare.com.

And, finally, the sponsors would direct the reader to Senate Bill 129 (S) RES “An Act relating to the oil and gas production tax; relating to credits against the oil and gas production tax; relating to payments of the oil and gas production tax; relating to lease expenditures and adjustments to lease expenditures; making public certain information related to the oil and gas production tax; relating to the Department of Revenue; and providing for an effective date.” Senate Bill 129 was sponsored by Senator Wielechowski and was prepared in cooperation with the sponsors and Legislative Legal. Senate Bill 129 was intended by the sponsors to be a substantially similar bill to the Fair Share Act in the proper legislative drafting style to help resolve any future ambiguities that may arise in the interpretation of the sponsors’ intention regarding the Fair Share Act or in how the Fair Share should be translated into the proper legislative drafting style. By style, the Fair Share Act is two-pages long and in the style most helpful and clear for the exercise of direct democracy by initiative. Senate Bill 129 is a longer and more detailed draft in the style most helpful and clear for the exercise of representative democracy.

THE FAIR SHARE ACT, SECTION 2 (APPLICABILITY)

Section 2 of the Fair Share Act (Applicability) states that the Fair Share Act only applies to an oil field or unit on the North Slope that has produced an average of 40,000 barrels per day in the last calendar year and over 400 million barrels cumulatively over the life of the field. Currently, the Fair Share Act would only apply to the production from our three largest and most profitable units: the Prudhoe Bay Unit (PBU or Prudhoe Bay), the Kuparuk River Unit (KRU or Kuparuk), and the Colville River Unit (CRU or Alpine). Accordingly, all oil production within the PBU, KRU, and CRU would be subject to the Fair Share Act regardless of which field within those units produces the oil.

The sponsors used both the term “unit” and the term “field’ to reduce the likelihood of manipulating the unit boundaries for self-interest. The intention is for the Fair Share Act to apply to the larger field or unit if there is overlapping applicability and would note that by convention, a unit is often referred to by the name of the largest field in that unit.

When a new field or unit meets the applicability criteria in the future, the Fair Share Act would apply to production from that field or unit as well as the beginning of the next tax year. For example, if in the future Milne Point, Willow, or Pikka meet the applicability criteria, then the Fair Share Act would apply.

As matter of sound oil policy, it is important for Alaskans to receive our fair share from the PBU, KRU, and CRU because they are three of the largest and most profitable conventional oil fields in North America. If we are not able to get a fair share from these three fields, we will have failed Alaska.

These three major fields are low-cost, high-profit legacy fields that can fully bear paying Alaskans a fair share. To use the PBU as an example, in 2018, it has a profit margin over costs and before taxes of roughly $40 per barrel. According to actual 2018 data, it only costs about $25 per barrel in operating and capital costs to produce and transport a barrel of oil from the PBU to the West Coast where it is sold for an average price of $63.61 per barrel.

In fact, since SB21, these three major fields have made the producers more than twice as much per barrel as they were able to make anywhere else in the world with major oil reserves. Both ConocoPhillips’ annual reports and the Legislative Research Services analysis of those annual reports demonstrate how much more they make in Alaska. Not only can these three major fields afford to pay Alaskans a fair share, but for over three decades before SB21 passed, these fields were able to or did pay Alaskans a fair share.

The Fair Share Act will increase Alaskans’ share in these three largest and most profitable fields by about $1.1 billion per year on average when compared with the current tax system from 2015 through 2019.

Equally important, the Fair Share Act will not currently apply to any oil produced outside of our three largest and most profitable fields (PBU, KRU, and CRU). Fields outside of our three major legacy fields may need support to help them get into production. We all want new explorers coming to Alaska to develop our oil and gas resources. The Fair Share Act will help them come to Alaska, because it will significantly reduce the political risk arising from our massive, unmanaged state deficits without impacting their business plans for our new and developing fields.

These are sound oil policies for Alaska.

THE FAIR SHARE ACT, SECTIONS 3 (ALTERNATIVE GROSS MINIMUM TAX) AND 4 (TAX ON PRODUCTION TAX VALUE).

Sections 3 (Alternative Gross Minimum Tax) and 4 (Tax on Production Tax Value) of the Fair Share Act increase the existing production taxes in the manner described below.

Greater of the Gross Calculation or the Net Calculation: As a preliminary matter, our current SB21 production system is based on the greater of the alternative gross minimum tax calculation or gross calculation (percentage of wellhead value), or the tax on production tax value or net calculation (percentage of profits). The Fair Share Act preserves this same basic structure but amends it to achieve a fairer share for Alaskans.

Changes to the Current Alternative Gross Minimum Tax Calculation (Gross Calculation): The gross calculation is based on a percentage of the gross value at the point of production after subtracting transportation costs to the West Coast. The Fair Share Act makes two changes to the current gross calculation. It increases Alaskans’ share from the three largest and most profitable oil fields from 4 percent to 10 percent. Then, it increases the 10 percent share progressively by 1 percent for each $5 increase in the price of oil above $50 per barrel, up to a maximum of 15 percent when the price of oil is at $70 per barrel or more.

The sound oil policies underlying these changes are important to understand. The current 4 percent fails under any standard of fairness. The two major ways Alaskans get a fair share is through royalties (which are not taxes) and the production tax. In North Dakota, for example, the average royalty is 18.7 percent of production, and the average production and severance tax is 10 percent of gross, or 28.7 percent in total. In comparison, in Alaska the average royalty is only 12.5 percent of production, and the average SB21 production tax is 4 percent, or 16.5 percent in total. If the cashable tax credits are also considered, Alaska’s production taxes have actually been negative since SB21 passed. In fact, nowhere in the world with major reserves gets less in combined royalties and production taxes than Alaskans do today.

Alaskans are also getting a smaller share under the production tax than at any time in our history. The five years before SB21, we realized $19.0 billion or $3.8 billion per year (after cashable credits). The five years after SB21, we got negative $0.1 billion per year (after cashable credits). While some adjustments are necessary to directly compare these numbers, there are no adjustments that support Alaskans getting negative net production taxes for the last five years under SB21. Under SB21, Alaska has not been able to pay all of the cashable credits the State has incurred and currently owes more than $700 million in incurred but unpaid cashable credits. The Fair Share Act seeks to bring this extreme inequity more into balance.

The current 4 percent share is a “soft” floor in that the major producers are arguing it can be less. Several producers are currently suing the state to reduce their payments below 4 percent. A “soft” floor makes an unreasonably low floor even worse, encourages unnecessary litigation, and creates uncertainty and risk over the calculation of our share when we need it the most. The Fair Share Act establishes a “hard” floor that cannot go below 10 percent under any circumstances.

Alaskans recover too little during periods of lower oil prices under the gross calculation. The party with the greatest capacity to manage risk should bear it. Since the producers can adjust project timing, budgets, and costs, they should bear most of the downside risk of lower oil prices. Under the current SB21 production tax, when the price of oil dropped 62 percent a few years ago, our share of revenues dropped 109 percent; i.e., our share shrank twice as fast as the price of oil declined. This sacrificed Alaskans’ share when we needed it the most and preserved the major oil producers’ profits.

A good illustration of this is during 2016 and 2017 when oil prices were lower. ConocoPhillips lost $4.6 billion in the Lower 48 while it made $1.8 billion in Alaska. This is because the current SB21 production tax recovered far less for Alaskans during periods of lower oil prices than owners in the Lower 48 were willing to accept. The Fair Share Act creates a more equitable sharing in lower oil-price environments.

Changes to the Current Tax on Production Tax Value Calculation (Net Calculation): The net calculation is a more complex and easier to manipulate calculation based on a percentage of the net revenues (gross revenues less allowed costs and credits) realized at the point of production, less transportation to the West Coast. The Fair Share Act makes two changes to the current net calculation. It increases Alaskans’ share from the three largest and most profitable oil fields by eliminating the $8 per revenue-barrel credit. It also adds an additional 15 percent tax on the portion of a producer’s production tax value (net profits) at $50 per barrel or more. This means that the existing tax on production tax value of 35 percent applies to the production tax value up to $50 per barrel, and a tax on production tax value of 50 percent (the existing 35 percent plus the additional tax of 15 percent) applies to the portion of production tax value above $50 per barrel.

It is important to understand the sound oil policies underlying these changes. Incentives to produce should only be given when there is not otherwise a legal duty to produce, the production could not otherwise economically occur, and the benefit from the incentives is greater than their cost. The current SB21 production tax gives a direct $8 reduction to production taxes for each revenue (non-royalty) barrel produced. For our largest and most profitable oil fields, the current $8 per revenue-barrel credit is unnecessary and violates the reasonable oil policies underlying incentives.

In the PBU in 2018, for example, the current SB21 production system reduced the major producers’ production taxes through the $8 per revenue-barrel credit by $742 million. The major producers in the PBU have a legal duty under their leases to invest in and produce oil from the PBU without any incentive. They would continue to produce oil from the PBU without the $8 per revenue-barrel credit because they have done so without incentives for over three decades and because the profit margins from the PBU are among the highest in the world. And, they have not created any benefit for Alaskans that remotely approaches the $742 million per year we are giving in incentives for the production from the PBU. In fact, state revenue, investment, production, and Alaskan jobs relating to the PBU are all down. The Fair Share Act eliminates the completely unnecessary $8 per revenue-barrel reduction from production taxes for our three largest and most profitable oil fields in Alaska.

Alaskans recover too little during periods of higher oil prices under the net calculation. As producers’ net profits increase, so should Alaska’s share because the major costs of production have already been recovered. The current SB21 production tax eliminated progressive rates so as the price of oil increases, Alaska’s share does not increase by much. This is a major reason why Alaska’s economy is doing so poorly even when oil prices recover.

In contrast to Alaska’s economy, ConocoPhillips has increased its shareholder dividends three times recently, repurchased $3 billion in stock in 2018, increased future stock repurchase authorizations up to $25 billion, and paid off over $12 billion in debt ahead of schedule. In times of higher profits when producers’ net profits are at $50 per barrel or more, the Fair Share Act will increase Alaska’s share by an additional 15 percent (above the 35 percent base) of these windfalls.

These are sound oil policies for Alaska.

THE FAIR SHARE ACT, SECTION 5 (SEPARATE TREATMENT).

Section 5 of the Fair Share Act (Separate Treatment) requires separation between oil and gas production, among the three major fields, and monthly when calculating the oil production taxes.

As a matter of sound oil policy, when we calculate our fair share under the net calculation for our three largest and most profitable fields, this should be based on the actual costs of producing oil from each of those fields. This is sometimes referred to as “ringfencing.” The current SB21 system permits our share to be reduced by costs of developing separate and unrelated oil and gas projects anywhere on the North Slope. In doing so, it defers our revenue years into the future with the risk that the revenue may never be recovered at all.

Perhaps this point is best explained by example. ConocoPhillips is currently developing the federal lands in the National Petroleum Reserve-Alaska (NPR-A) and is deducting the costs of development from our share of revenues from our three major fields. As a result, our production taxes are about to decline by an additional $300 million per year for most of the next decade. Under Section 5, the costs of developing and producing oil from other fields cannot be deducted in the calculation of production taxes for the PBU, the KRU, or the CRU.

Further, since ConocoPhillips is drilling on federal lands in NPR-A, Alaskans’ royalty interest is half or less of what we normally earn from state lands and even that half is exposed to third-party impact claims. In short, Alaskans are paying $300 million per year in reduced production taxes to subsidize ConocoPhillips’ development of federal lands when it is not clear when or if Alaskans will ever recover their subsidy in the future. Stated differently, ConocoPhillips’ spending under our current SB21 production system on the development of NPR-A will substantially increase our state budget deficit for most of the next decade and could cost Alaskans more revenue than it ever earns us.

The potential impact from not ringfencing our three major fields under the current SB21 production tax system is staggering when one considers large future projects such as ANWR or a gas project. When ANWR is built out there will be billions in expenses incurred. Section 5 maintains a separation among oil fields or ringfences them so that the costs of developing ANWR or any other another field or producing oil from another field will not impact the production tax calculation for the PBU, the KRU, or the CRU.

Similarly, when the natural gas pipeline is built, at least $5 billion will be spent by the major producers, largely to build out the Point Thomson gas field. Under the current SB21 production system, those producers could deduct the $5 billion they spent on the gas project from our share of oil production revenues for the PBU, the KRU, and the CRU, greatly reducing our oil production taxes for years. Moreover, allowing the costs for a lower-margin natural gas project to be deducted from our share of the higher-margin major oil fields would diminish our production share indefinitely. Section 5 maintains a separation between gas and oil, so a gas project will not impact the production tax calculation for oil.

Finally, the current SB21 production system creates a competitive disadvantage for the new explorers we are trying so hard to attract to Alaska. A new producer may not deduct the costs of developing a new oil field until there is production from that new field. The legacy producers, however, may deduct the costs of developing the new field from the production taxes of the three major fields and do not need to wait for the new field to produce. Requiring new producers to wait for years to deduct costs while permitting the legacy producers to immediately deduct those same costs creates an unfair competitive advantage for legacy producers and makes it harder to attract new companies to Alaska.

The Fair Share Act only permits the costs of producing oil from each of our three largest and most profitable oil fields to be deducted only from our production taxes for each of those fields. For example, only the costs of producing oil from the PBU may be deducted from the calculation of production taxes for the PBU. And, the same would be true for the KRU and the CRU.

The Fair Share Act also requires the separate monthly calculation of production taxes. This requires a monthly calculation of the gross and net calculation and the estimated payment of whichever is greater each month for each unit. At the end of the year, these estimates would be trued up for each month for each unit. So, under the Fair Share Act, if in one month the gross tax was greater, the gross tax would be the basis for the estimated monthly payment and the basis for the annual true up for that month at the end of the year, while, if in another month the net tax was greater, the net tax would be the basis for the estimated monthly payment and the basis for the annual true up for that month at the end of the year. Under the current SB21 production tax system, the annual true up averages all months together and either applies the greater of the gross or the net calculation to the entire year. The Fair Share Act changes this so the annual true up respects the greater of the gross or the net calculation for each separate month. This would require a monthly estimated payment based on the greater of the gross or net calculation and an annual tax filing truing up each month for each of the three units–the PBU, the KRU, and the CRU. This is comparable to how the progressive tax calculation was estimated and then trued up monthly under the “ACES” tax regime from 2007-2013.

Oil prices and profitability are quite variable from month to month, and requiring the tax to be based on the greater of the gross or net calculation each month would permit Alaska to better share in the temporary spikes to oil prices and profitability as they may occur monthly. These changes ensure Alaskans will get a fair share from our three largest and most profitable oil fields and levels the playing field between new and legacy producers.

Finally, Section 5 also makes clear that the calculation of gross and net production taxes for oil are separate from the calculation for gas.

These are sound oil policies for Alaska.

THE FAIR SHARE ACT, SECTION 7 (PUBLIC RECORDS).

Section 7 of the Fair Share Act (Public Records) requires all filings and supporting information for each producer in each of our three major fields to be public. Section 7 is not intended to leave whether this information may be made public to the discretion of an administrative agency.

As a matter of sound oil policy, Alaskans are the stewards of hundreds of billions of dollars of oil resources and must have access to the information necessary to provide proper stewardship. Alaskans own the land and the oil being produced from our major three oil fields—Prudhoe Bay, Kuparuk, and Alpine. This means Alaskans are in business with the producers of our three largest and most profitable oil fields. However, under the current SB21 production system, the revenues, costs, and profits from the major producers in these major oil fields are not publicly disclosed to Alaskans—the owners of the resource.

There is no possible justification for Alaskans not to know how our three major fields are financially performing. In fact, it is our obligation to know as the owners of resources worth hundreds of billions of dollars that will literally shape the present and future of Alaska. Without having access to the true revenues, costs, and profits of each producer of these three major fields, Alaskans are left to make oil policies based on fear and misinformation. To see the value of having the best information possible, one only need look at our efforts to get a fair share for Alaskans. The major producers spent tens of millions of dollars drafting, persuading our Legislature to pass, and persuading Alaskans not to repeal the current SB21 production system. The information Alaskans were provided about SB21 has not proven accurate or reliable. We were told SB21 would increase revenues, investment, production, and jobs. Instead, we are getting less revenues, less investment, less production, and fewer jobs. Alaskans need to make oil policy on good information, not slick media campaigns designed to convince Alaskans we will be better off if we take less for our oil.

The information we do have demonstrates the producers in Prudhoe Bay are making huge profits each year and that ConocoPhillips will make twice as much in Alaska after the Fair Share Act passes than it does in the Lower 48 or internationally. The information we do have suggests investment in Alaska will not be impacted by passage of the Fair Share Act. For that matter, for three decades before SB21 passed, there was investment in Alaska and Alaskans were getting a fair share from most fields.

Alaskans need good and reliable information to be responsible stewards of our oil resources. Our Legislators need it to evaluate and adopt proper oil policies into law. Our Governor and administration need it to monitor and evaluate our oil policies and develop proper laws and regulations to improve them.

Currently, the only cost information that is available for our major fields is for Prudhoe Bay. Because of concern for the producers, the cost information for every other field is not made separately available. There is no revenue or profit information available to Alaskans for any field. ConocoPhillips is required to report financial performance by geographic region but reports it for its entire combined Alaska operations rather than by field. Exxon and BP do not report their Alaskan operations separately at all, and Hilcorp (which is privately held) does not report any financial information at all.

The Fair Share Act requires the major producers’ production tax filings to be publicly disclosed for each of our three major fields and will provide us with the information Alaskans need to sit at the table and negotiate sound oil policies in the future. There is a saying, “You are either at the negotiating table with good information or you are on it.” Alaskans should be at the table with the best information possible; today, we are on it.

This is a sound oil policy for Alaska.

Modeling Ballot Measure 1:

Detailed modeling done on Ballot Measure 1 has been done by the former Tax Director for the Division of Revenue, Ken Alper. Alper has modeled oil tax policy in Alaska for decades and is a well-respected production tax and policy expert who is often called upon to model and analyze production tax proposals. “Ken Alper is one of the foremost experts on Alaska’s oil tax policies, and his modeling and presentations to the Legislature over the years have proven invaluable,” observed former Chair of House Finance and Co-Chair of House Resources Paul Seaton (R).

Seaton further commented, “Ballot Measure 1 changes the minimum rate, eliminates unnecessary credits, ring fences, and adds progressivity.” “These are all sound oil policies the Legislature has been unable to maintain because of the political influence of the major oil companies,” Seaton observed. “We have had higher minimum rates, no credits, ring fencing, and progressivity in various forms in the past.” “Most recently, the Legislature considered these oil policies with HB111, HB411, and SB21, and the Legislature had the full opportunity to consider these oil policies in the context of Ballot Measure 1 on three separate occasions, when it held hearings in the Senate and House on Ballot Measure 1 and when Ballot Measure 1 was introduced in bill form in SB129,” Seaton offered. “The oil policies advanced by Ballot Measure 1 are sound, have been in place in the past, and the Legislature has had ample opportunity to consider these sound policies,” Seaton concluded.

Vote Yes has chosen to set forth some of the detailed modeling results prepared by KMA Associates in which Alper is the principal because of the “confusion being caused by our opposition misrepresenting Ballot Measure 1 to Alaskans,” Ballot Measure 1 sponsor Robin Brena stated. “Our opposition keeps conflating issues and causing confusion over even obvious things,” Brena explained, “so we thought we would lay out some of Ken’s detailed modeling to make the issues clearer for Alaskans.”

“As a consultant for Vote Yes, KMA Associates has done extensive modeling on Ballot Measure 1 to determine its impacts to both the producers in the three major legacy fields and to Alaska,” commented Alper, “I built a proprietary model for this project, which is similar to models I’ve used for many years to estimate oil and gas revenues in Alaska.” “The inputs are entirely from reliable and public sources published by the Alaska Department of Revenue,” Alper noted, “These sources included the Department’s Revenue Sources Book published each fall and updated each spring, annual reports on oil tax credits, and publicly available reports on certain field-specific lease expenditures on the North Slope. For those fields in which specific lease expenditure data is not publicly available, some extrapolation was necessary.” “The transparency the sponsors put into Ballot Measure 1 would help make this type of data more accessible,” Alper concluded.

Following is (1) a brief description of the modeling and slides released by Vote Yes today, (2) the Key Points illustrated by the modeling and slides, and (3) each slide with the detailed analysis of the information on the slide and its significances to the policies underlying the Fair Share Act.

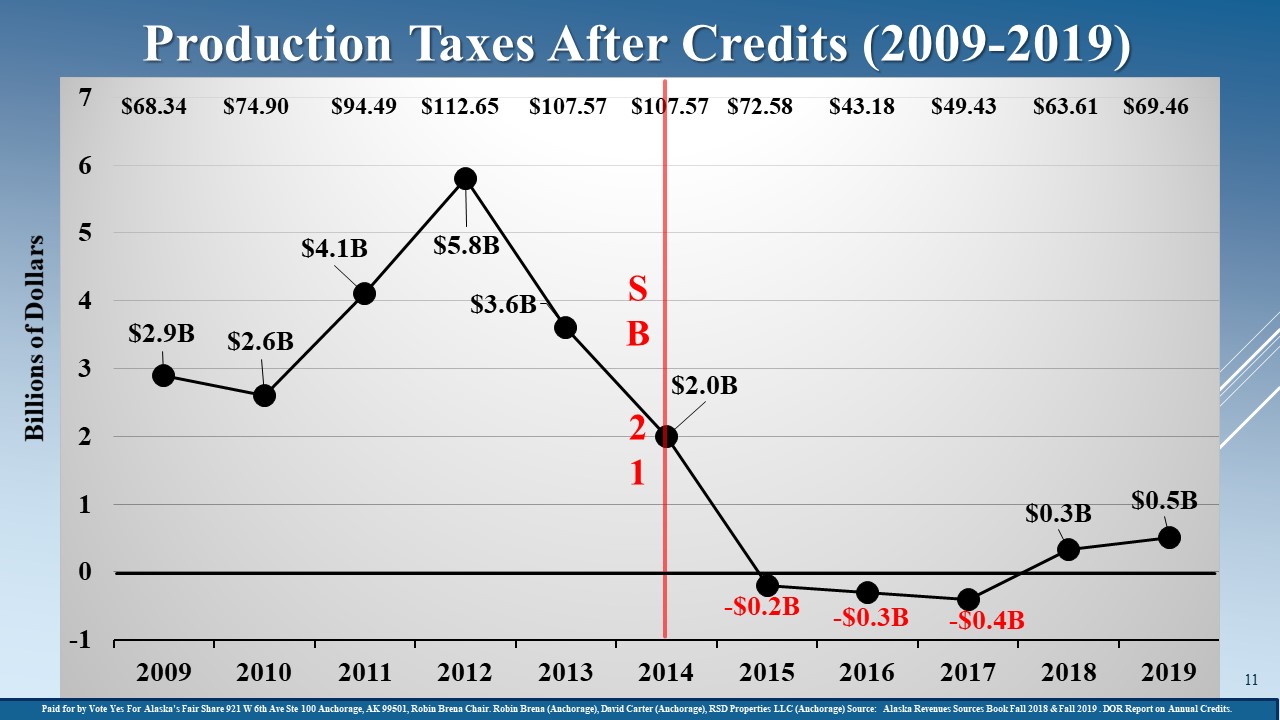

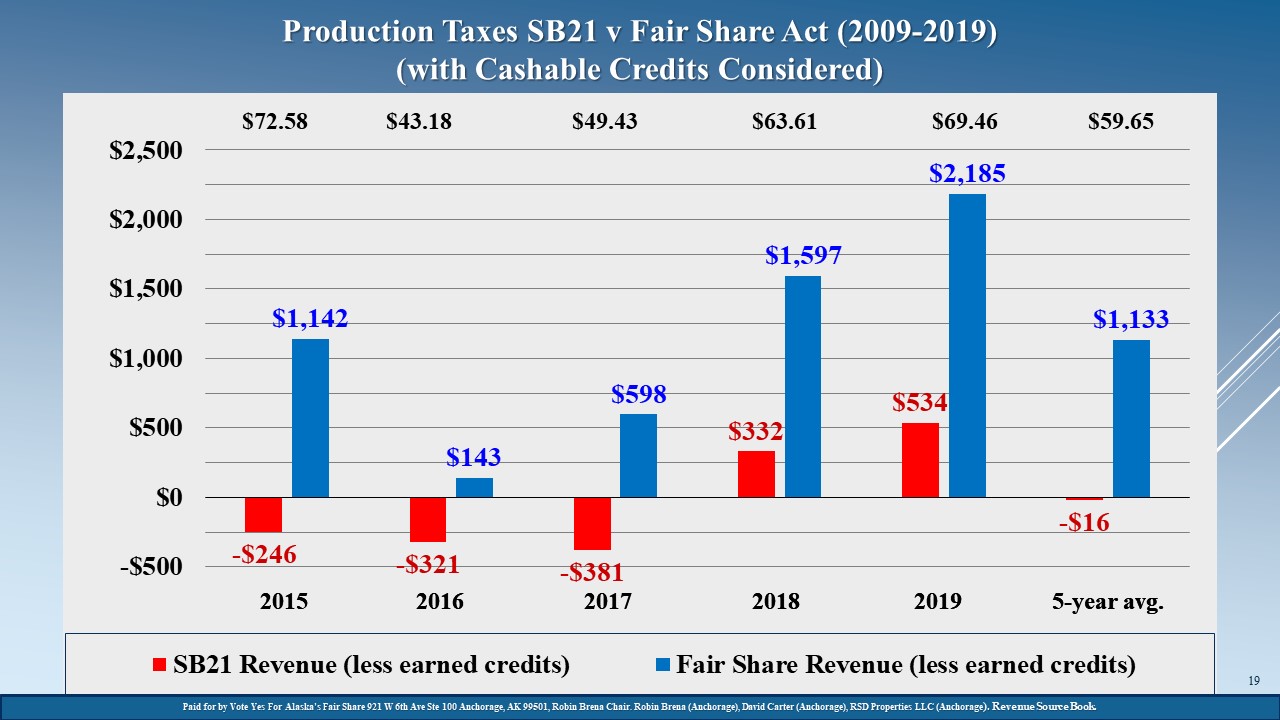

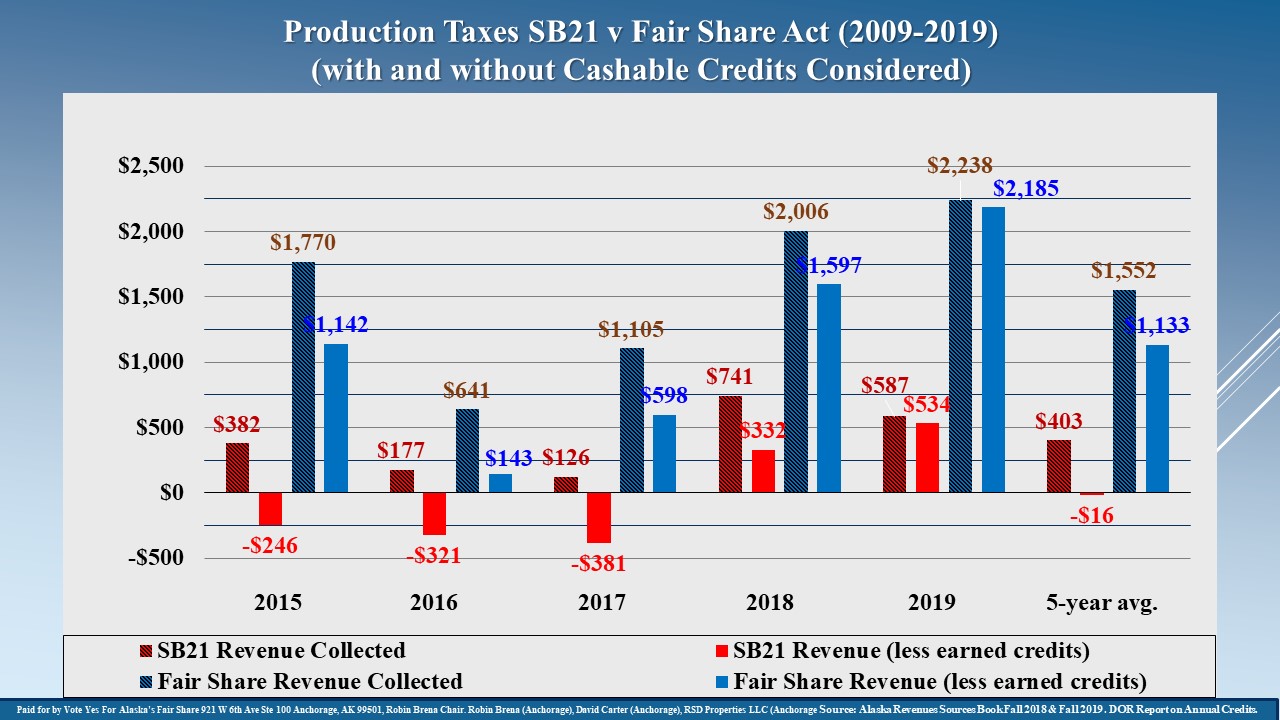

Look-Back Slides 1-3: These slides set forth the actual net production taxes from 2009 through 2019, and compare the production taxes under SB21 with Ballot Measure 1 (the Fair Share Act) based on the five full-fiscal years SB21 has been in effect (2015-2019) with and without cashable credits considered.

Key Points Illustrated by Look-Back Slides:

- Our net production taxes have collapsed from a five-year average of $3.8 billion before SB21 to less than zero after SB21.

- Since SB21, the State has paid and owes more in cashable credits ($2.1 billion) than it has received in production taxes ($2.0 billion).

- SB21, and not a change to the price of oil, is the primary driver behind the collapse of the State’s production taxes.

- When oil prices were $65 per bbl., the State recovered $12 per bbl. in production taxes before SB21 and $2 per bbl. after SB21.

- When the oil price remained the same from fiscal year 2013 (before SB21) to 2014 (SB21 was in effect for six months), our net production taxes declined by $1.6 billion.

- If Ballot Measure 1 had been in effect during the same five-year period SB21 has been in effect, Ballot Measure 1 would have resulted in $5.5 billion more in total production taxes or $1.1 billion more per year.

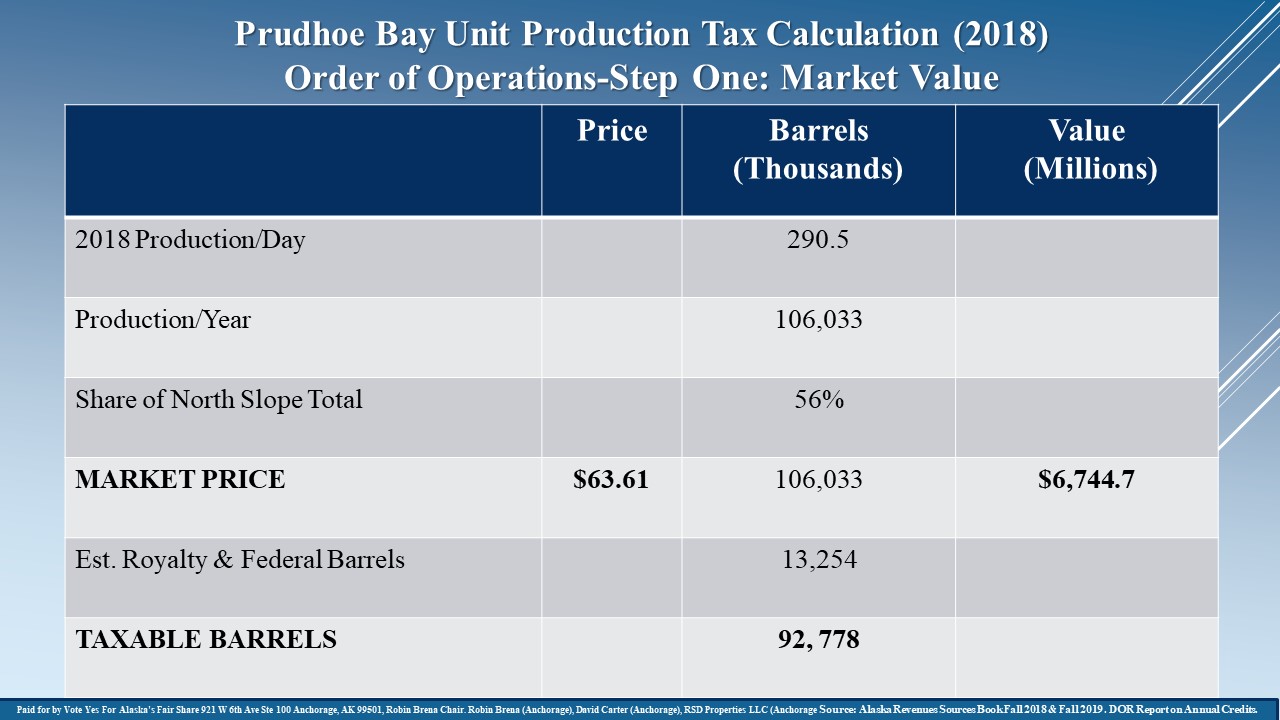

Order-of-Operations Slides 1-6. These slides compare a detailed order-of-operations calculation of the production taxes for the largest of the three major legacy fields, the Prudhoe Bay Unit, under SB21 and Ballot Measure 1 (the Fair Share Act) for 2018.

Key Points Illustrated by Order-of-Operations Slides:

- In 2018, the Prudhoe Bay Unit produced 106 million bbls. at an average oil price of $63.61 per bbl., which resulted in $6,744.7 million of market value.

- Production taxes on the market value are determined by the greater of a gross minimum tax calculation or a net tax calculation.

- The gross minimum tax calculation is based on gross value at the point of production times a rate. Both SB21 and Ballot Measure 1 calculate the gross value at the point of production the same for the Prudhoe Bay Unit at $5,055.5 million. Both SB21 and Ballot Measure 1 apply a rate based on the price of ANS oil, which was $63.61 per bbl. in 2018. At this price of ANS oil, SB21 applies a 4% rate and determines the gross minimum tax at $202.2 million. Ballot Measure 1 applies a 13% rate and determines the gross minimum tax at $657.2 million.

- The only difference between the gross minimum tax calculation under SB21 and Ballot Measure 1 is the rate applied to the gross value at the point of production. SB21 allows the rate to go to a 0% minimum floor, but the rate is 4% when ANS oil prices are over $25 per bbl. Ballot Measure 1 allows the rate to go to a 10% minimum floor. As a resource owner with significant oil resources, there is no justification for the State to take such massive downside risk at lower ANS oil prices when it has no control over managing the risk and gets so little of the benefit at higher ANS oil prices.

- The net tax calculation is based on net production value times a rate. SB21 permits and Ballot Measure 1 does not permit expenses unrelated to the Prudhoe Bay Unit to be deducted when determining the net production value of production from the Prudhoe Bay Unit. As a result, SB21 deducts unrelated expenses and determines the production tax value for production at the Prudhoe Bay Unit at $2,777 million, then applies a 35% rate to calculate the net tax calculated at $971.9 million. Ballot Measure 1 does not deduct unrelated expenses and determines the production tax value at $3,683.5 million, then applies a 35% rate to calculate a net tax calculated at $1,289.2 million.

- SB21 further permits the net tax calculated of $971.9 million to be reduced by an $8 per revenue bbl. credit or by $742.2 million for a net tax payable of $229.7 million. Ballot Measure 1 eliminates this $8 per revenue bbl. credit and requires the net tax calculated of $1,289.2 million to be the net tax payable. Thus, the net tax payable for production at the Prudhoe Bay Unit is $229.7 million under SB21 and $1,289.2 million under Ballot Measure 1.

- There is no justification for permitting unrelated expenses to be deducted from the net production value or for an $8 per revenue bbl. credit for production for the Prudhoe Bay Unit. The Prudhoe Bay Unit went into production over 40 years ago when the price of ANS oil was under $4 per bbl.

- The State should not permit deductions from the production taxes of the Prudhoe Bay Unit for unrelated expenses. For example, under SB21, ConocoPhillips is deducting the expenses of developing federal lands in NPR-A from our current production taxes from the Prudhoe Bay Unit. This is expected to reduce our production taxes and increase our State deficit by roughly $300 million per year for most of the next decade. There is no assurance the State will recover these lost production taxes. Also, new explorers are not able to deduct their expenses from our current production taxes at the Prudhoe Bay Unit. As a result, Ballot Measure 1 helps level the playing field between legacy producers and new explores.

- The State should also not permit $8 per revenue bbl. credits for production from the Prudhoe Bay Unit. This reduced the State’s production taxes by $742.2 million in 2018 alone. The producers have a legal obligation to produce the oil in the Prudhoe Bay Unit. They also receive an overwhelming economic benefit from producing the oil in the Prudhoe Bay Unit. Providing $742.2 million of credits for production that would have occurred anyway to producers that only invested $202 million of capital in the Prudhoe Bay Unit cannot be economically rationalized and is poor oil policy.

Look-Back Slides 1-3: These slides set forth the actual net production revenue from 2009 through 2019, and compare the production revenue under SB21 with Ballot Measure 1 (the Fair Share Act) based on the five full-fiscal years SB21 has been in effect (2015-2019) with and without cashable credits considered.

Look-Back Slide 1: Production Taxes After Credits (2009-2019)

Look-Back Slide 1 sets forth the actual net production taxes for fiscal years 2009 through 2019. Net production taxes are the actual production taxes received by the State less the cashable credits paid and owned by the State for each year. For the five years before SB21 (2009-2013), Alaska’s net production taxes were $19 billion total or $3.8 billion per year. For the five years after SB21 (2015-2019), Alaska’s net production taxes were negative ($0.1) billion total or negative $(0.02) billion per year.

The ANS oil price for each year is on the top of Look-Back Slide 1. The average price of ANS oil was 35% higher during the 2009-2013 five-year period than in the 2015-2019 five-year period. Given comparable ANS oil prices, SB21 has a significant negative impact on production taxes. In 2013 and 2014, the price of ANS oil was identical at $107.57 per bbl., but net production taxes declined by $1.6 billion as the result of SB21. In 2009, the price of ANS oil was $68.34 per bbl., and Alaska recovered production taxes of $12.09 per bbl. without considering credits, while in 2015 under SB21, the price of ANS oil was $72.58 per bbl. (an increase of $4.24 per bbl. from 2009) and Alaska only recovered production taxes of $2.01 per bbl. without considering credits, or one-sixth as much as before SB21.

Look-Back Slide 1 illustrates the collapse of our net petroleum taxes from $3.8 billion per year to negative ($0.02) billion per year was primarily the result of SB21.

Look-Back Slide 2: Five-Year Lookback of Production Taxes under SB21 and Ballot Measure 1 (with Cashable Credits Considered).

Look-Back Slide 2 compares the production taxes with cashable credits considered for the five fiscal years (2015-2019) under SB21 (actual) and under Ballot Measure 1 (modeled by Alper). SB21 resulted in negative production taxes in three of the five years with cashable credits considered. When the price of oil was $72.58 per bbl. in 2015, for example, the production taxes with cashable credits considered was negative ($246) million under SB21 and positive $1,142 million under Ballot Measure 1. The five-year average in production taxes with cashable credits considered was negative ($16) million under SB21 and positive $1,133 million under Ballot Measure 1, or a $1,117 million difference.

Look-Back Slide 2 demonstrates that under SB21 the State has paid the producers more in cashable credits than the producers have paid the State in production taxes. It also demonstrates that over a range of oil prices and circumstances during the past five years, Ballot Measure 1 would have resulted in average production taxes when cashable credits are considered of $1,117 million more than SB21.

Cashable credits are considered in this comparison because, when evaluating the performance of the current tax system, it is important to consider both the amount the State paid and still owes in cashable credits and the amount the State received in production taxes. While the cashable credit program has expired, the State continues to owe $738 million in cashable credits that it has not been able to pay as the result of the collapse of production taxes under SB21.

Look-Back Slide 3: Five-Year Lookback of Production Taxes under SB21 and Ballot Measure 1 (With and Without Cashable Credits Considered).

Look-Back Slide 3 compares the production taxes (with and without cashable credits considered) for five fiscal years (2015-2019) under SB21 and Ballot Measure 1. The results of Look-Back Slide 2 are represented in Look-Back Slide 3. In addition, Look-Back Slide 3 sets forth the production taxes without cashable credits considered. The five-year average in production taxes without cashable credits considered was $403 million under SB21 and $1,552 million under Ballot Measure 1 or a $1,149 million difference.

Look-Back Slide 3 demonstrates that without considering cashable credits over the five-year period, Ballot Measure 1 recovered a minimum of $464 million (2016) when the price of oil was $43.18 per bbl. and a maximum of $1,651 million (2019) when the price of oil was $69.46 per bbl. On average, Look-Back Slide 3 shows that, even when cashable credits are not considered, Ballot Measure 1 would recover roughly $1.1 billion per year more than SB21 during the five-year period (2015-2019) SB21 has been in effect. Thus, the differences in the production taxes between SB21 and Ballot Measure 1 are roughly the same with or without cashable credits considered.

Order-of-Operations Slides 1-6. These slides compare a detailed order-of-operations calculation of the production taxes for the largest of the three major legacy fields, the Prudhoe Bay Unit, under SB21 and Ballot Measure 1 (the Fair Share Act) for 2018.

Order-of-Operations Slides 1-6 provide a six-step order of operations calculation of production taxes that compares the calculation of production taxes for the Prudhoe Bay Unit under SB21 and the Fair Share Act for 2018. The Prudhoe Bay Unit was chosen for the detailed comparison because most of the additional production taxes under Ballot Measure 1 are the result of additional taxes from the Prudhoe Bay Unit. The Prudhoe Bay Unit is the largest conventional oil field in North America. It is a low-cost, high-profit field that has been in production since 1977 and was authorized to be developed and the Trans Alaska Pipeline System to be built when the price of oil was under $4 per bbl.

These Order-of-Operations Slides demonstrate both the similarities and the primary differences between SB21 and Ballot Measure 1. The primary reasons Ballot Measure 1 increases the production taxes from the Prudhoe Bay Unit is because Ballot Measure 1 no longer permits costs unrelated to the production of oil from the Prudhoe Bay Unit to be deducted from the production taxes of the Prudhoe Bay Unit, and because Ballot Measure 1 eliminates the unnecessary $8 per revenue-bbl. credits for production from the Prudhoe Bay Unit.

Order-of-Operations Slide 1: Step One—Calculation of Market Value.

Order-of-Operations Slide 1 shows step one in the calculation of production taxes: the calculation of the market value on the West Coast of crude oil produced from the Prudhoe Bay Unit in 2018. Ballot Measure 1 does not amend SB21 with regard to the calculation of the market value, so step one is the same under SB21 and Ballot Measure 1.

Market value is calculated by multiplying the total production for the Prudhoe Bay Unit by the average ANS (West Coast) crude oil price, as reported in the Revenue Sources Book for 2018. Order-of-Operations Slide 1 also breaks out the royalty and federal barrels of production from the revenue barrels of production because only revenue barrels are subject to production taxes.

Order-of-Operations Slide 1 demonstrates that in 2018, the Prudhoe Bay Unit produced 106 million barrels at a price of $63.61 per bbl. or $6,744.7 million in total market value.

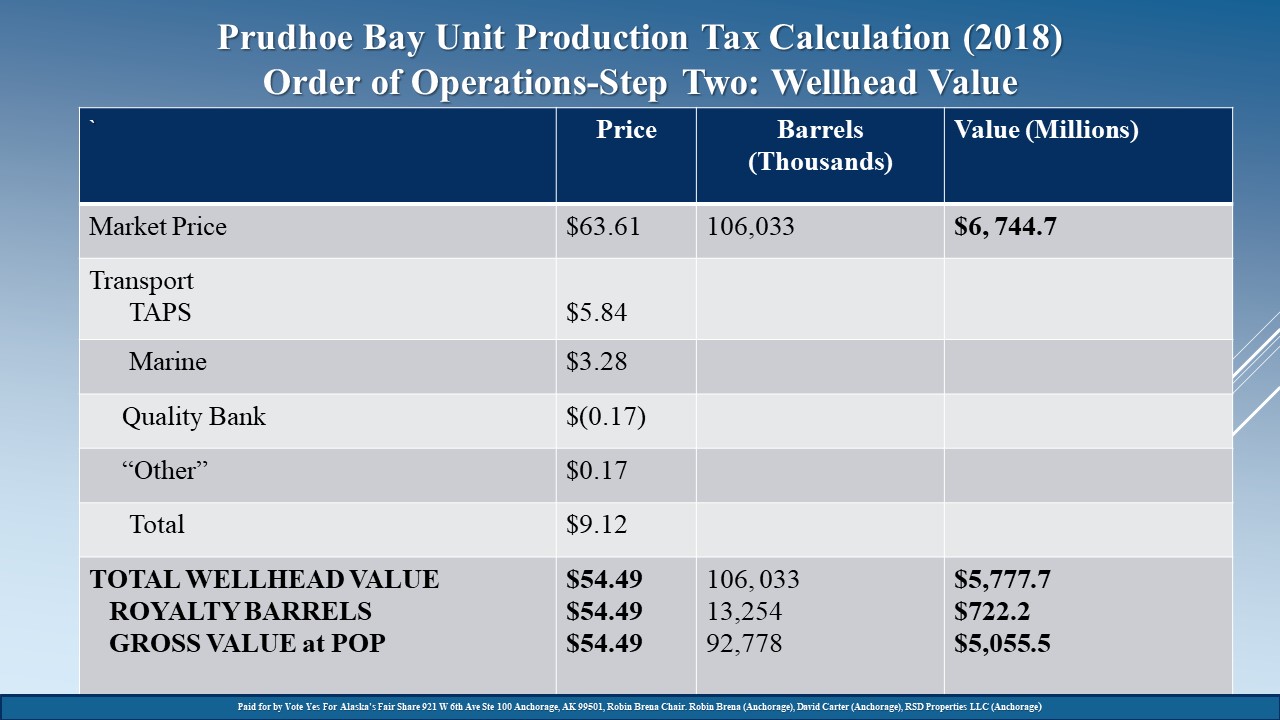

Order-of-Operations Slide 2: Step Two—Deduction of Transportation Expenses.

Order-of-Operations Slide 2 shows step two in the calculation of production taxes: the calculation of the wellhead value of crude oil produced from the Prudhoe Bay Unit in 2018. Ballot Measure 1 does not amend SB21 with regard to the calculation of the wellhead value, so step two is the same under SB21 and Ballot Measure 1.

The wellhead value is calculated by subtracting the transportation expenses to the West Coast from the market value on the West Coast. The primary transportation expenses are for pipeline ($5.84 per bbl.) and marine transportation ($3.28 per bbl.).

Order-of-Operations Slide 2 shows the total market value on the West Coast of $6,744.7 million, less the transportation expenses of $967 million, for a total wellhead value at the Prudhoe Bay Unit of $5,777.7 million. It also shows the wellhead value of the royalty barrels, or $722.2 million, is deducted from the wellhead value of $5,777.7 million to calculate the wellhead value of the remaining revenue barrels, or $5,055.5 million.

Order-of-Operations Slide 2 demonstrates that transportation expenses are subtracted before the production taxes are determined and so are borne by both the producers and the State. Transportation expenses also include the profits and tax allowances associated with transportation by the major producers’ affiliated pipeline and marine companies.

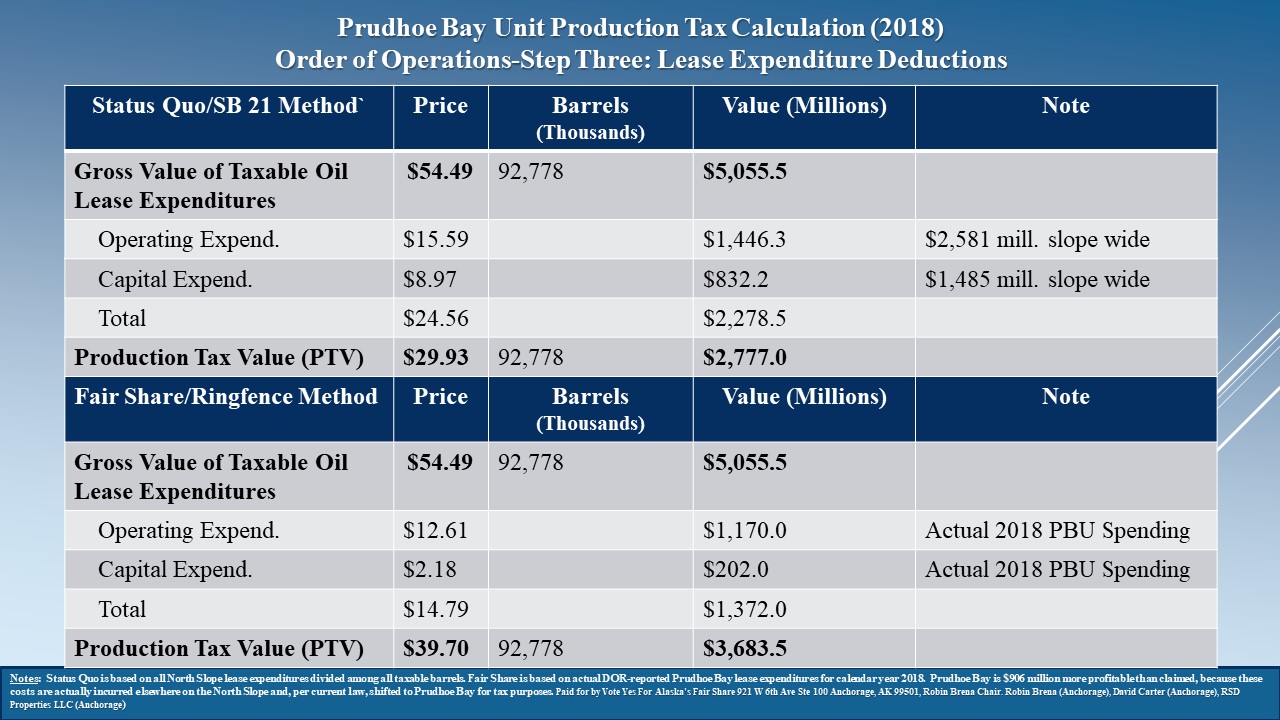

Order-of-Operations Slide 3: Step Three—Deduction of Lease Expenditures.

Order-of-Operations Slide 3 shows step 3 in the calculation of production taxes: the deduction of lease expenditures from the Prudhoe Bay Unit in 2018. Ballot Measure 1 does amend SB21 with regard to the deduction of lease expenditures, so step three is significantly different under SB21 and Ballot Measure 1.

SB21 permits expenses unrelated to producing oil from the Prudhoe Bay Unit to be deducted from the calculation of production taxes from the Prudhoe Bay Unit. Specifically, SB21 permits the deduction of prorated ANS-wide expenses (that includes significant expenses unrelated to the Prudhoe Bay Unit) of $1,446.3 million in total or $15.59 per bbl. in operating expenses and $832.2 million in total or $8.97 per bbl. in capital expenses. Deducting expenses that includes those expenses unrelated to the Prudhoe Bay Unit results in production tax value in 2018 of $2,777 or $29.93 per bbl. under SB21.

Ballot Measure 1 limits the deductions to only those expenses that are related to the Prudhoe Bay Unit. This is sometimes referred to as “ring fencing.” Specifically, Ballot Measure 1 only permits the actual expenses related to the Prudhoe Bay Unit of $1,170 million in total or $12.61 per bbl. in operating expenses and of $202 million in total or $2.18 per bbl. in capital expenses. Limiting deductions to expenses related to the Prudhoe Bay Unit results in production tax value in 2018 of $3,683.5 or $39.70 per bbl. under Ballot Measure 1.

Allowing legacy producers to deduct expenses unrelated to the Prudhoe Bay Unit under SB21 significantly reduces the State’s production taxes, results in an unfair competitive advantage for legacy producers over new explorers, and exposes the State’s production taxes to substantial and unnecessary future risk or loss. For example, the State has calculated that ConocoPhillips’ spending in NPR-A may reduce the State’s production taxes by roughly $300 million per year for most of the next decade, and it is not clear whether or when the State may ever recover these lost revenues.

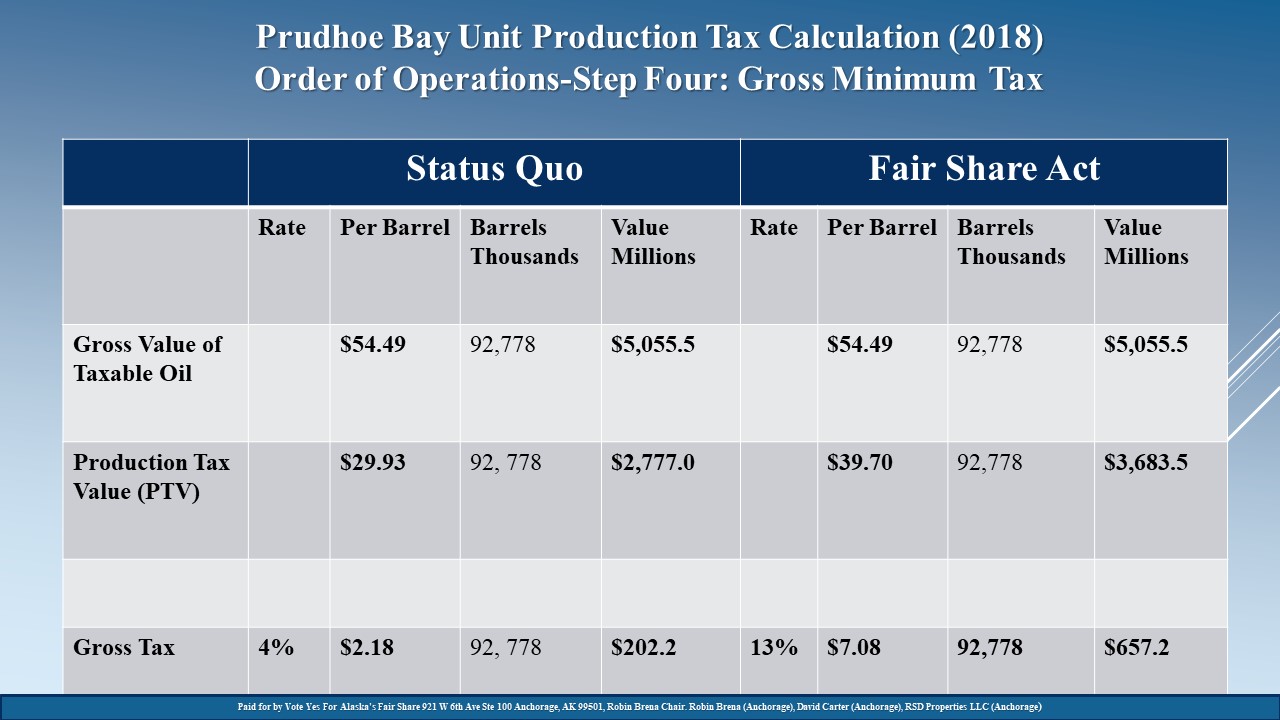

Order-of-Operations Slide 4: Step Four—Calculation of Gross Minimum Tax.

Order-of-Operations Slide 4 shows step 4 in the calculation of production taxes: the calculation of the gross minimum tax for the Prudhoe Bay Unit in 2018. Both SB21 and Ballot Measure 1 calculate the gross minimum tax based on the gross value of taxable oil at the wellhead, but they apply different rates.

Under SB21, when the price of ANS oil on the West Coast is greater than $25 per bbl., the rate is 4%. This 4% rate under SB21 does not increase progressively as the price of oil increases above $25 per bbl. Since the price of ANS oil was $63.61 per bbl. in 2018, the minimum gross tax would be 4% of the $5,055.5 gross value of taxable oil at wellhead or $202.2 million under SB21.

Under Ballot Measure 1, when the price of ANS oil is equal to or greater than $60 per bbl. and under $65 per bbl., the rate is 13%. This rate is based on a floor rate of 10% below $50 per bbl. and increases by 1% up to a maximum of 15% for each $5 increase in the price of ANS oil. Since the price of ANS oil was $63.61 per bbl. in 2018, the minimum gross tax would be 13% of the $5,055.5 gross value of taxable oil at wellhead or $657.2 million under Ballot Measure 1.

Also, SB21 sets the rate applied to the gross minimum tax annually while Ballot Measure 1 sets the rate monthly. This example assumes the price of oil was constant throughout 2018. To the degree the price of oil varied from month to month, Ballot Measure 1 would apply the appropriate rate to each month. This allows the State to have a 10% floor rate and share in the benefits when the price of oil temporarily spikes.

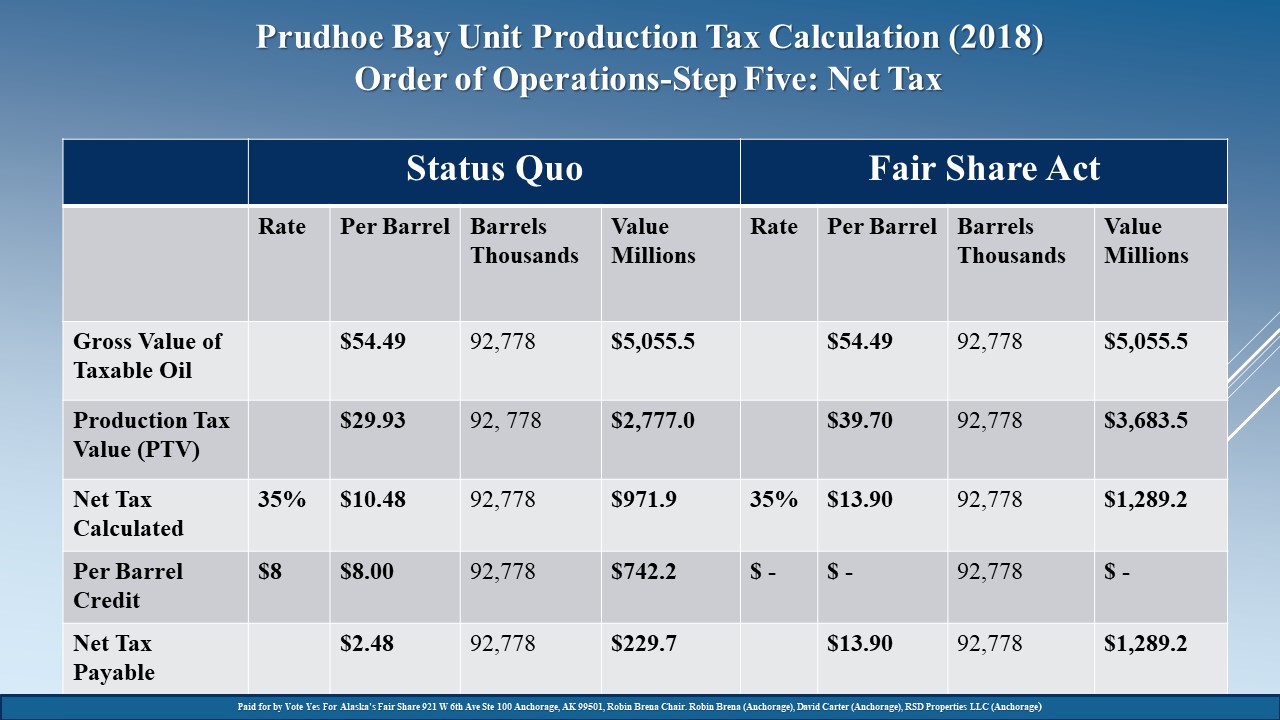

Order-of-Operations Slide 5: Step Five—Calculation of Net Tax.

Order-of-Operations Slide 5 shows step 5 in the calculation of production taxes: the calculation of the net tax for the Prudhoe Bay Unit in 2018. Both SB21 and Ballot Measure 1 calculate the net tax based on the production tax value. As explained in Order-of-Operations Slide 3, however, because SB21 permits expenses unrelated to the Prudhoe Bay Unit to be deducted and Ballot Measure 1 does not, the production tax value under SB21 is $2,777 million while the production tax value under Ballot Measure 1 is $3,683.5 million.

When the price of ANS oil is $63.61 per bbl., both SB21 and Ballot Measure 1 apply a 35% rate to the production tax value to determine the net tax. Under SB21, 35% of the production tax value of $2,777 million results in a net tax calculated of $971.9 million. Under Ballot Measure 1, 35% of the production tax value of $3,683.5 million results in a net tax calculated and payable of $1,289.2 million.

Notably, SB21 reduces the net tax calculated through applying $8 per revenue bbl. credits. Since there were 92,778 million revenue bbls. produced from the Prudhoe Bay Unit in 2018, SB21 provides a $742.2 million credit against the net tax calculated that reduces the net tax payable from $971.9 million to $229.7 million.

Because the producers in the Prudhoe Bay Unit are legally obligated to produce the oil and there is no economic justification for $8 per revenue bbl. credits for the largest and most profitable conventional oil field in North America that has been producing oil for over 40 years without such credits, Ballot Measure 1 eliminates the $8 per revenue bbl. credits. As the result, under Ballot Measure 1, the net tax calculated of $1,289.2 million is not reduced through the $8 per revenue bbl. credits.

SB21’s award of $8 per revenue bbl. credits or $742.2 million for oil that would have been produced anyway without any credits is perhaps the largest single difference between SB21 and Ballot Measure 1. SB21 provided $742 million in $8 per revenue bbl. credits in 2018 even though the producers only invested $202 million of capital in the Prudhoe Bay Unit.

As the result of limiting deductions to expenses associated with the Prudhoe Bay Unit and eliminating the $8 per revenue bbl. credits, Ballot Measure 1 would realize $1,289.2 million in net tax while SB21 would realize $229.7 million in net tax—a $1,059.5 million difference.

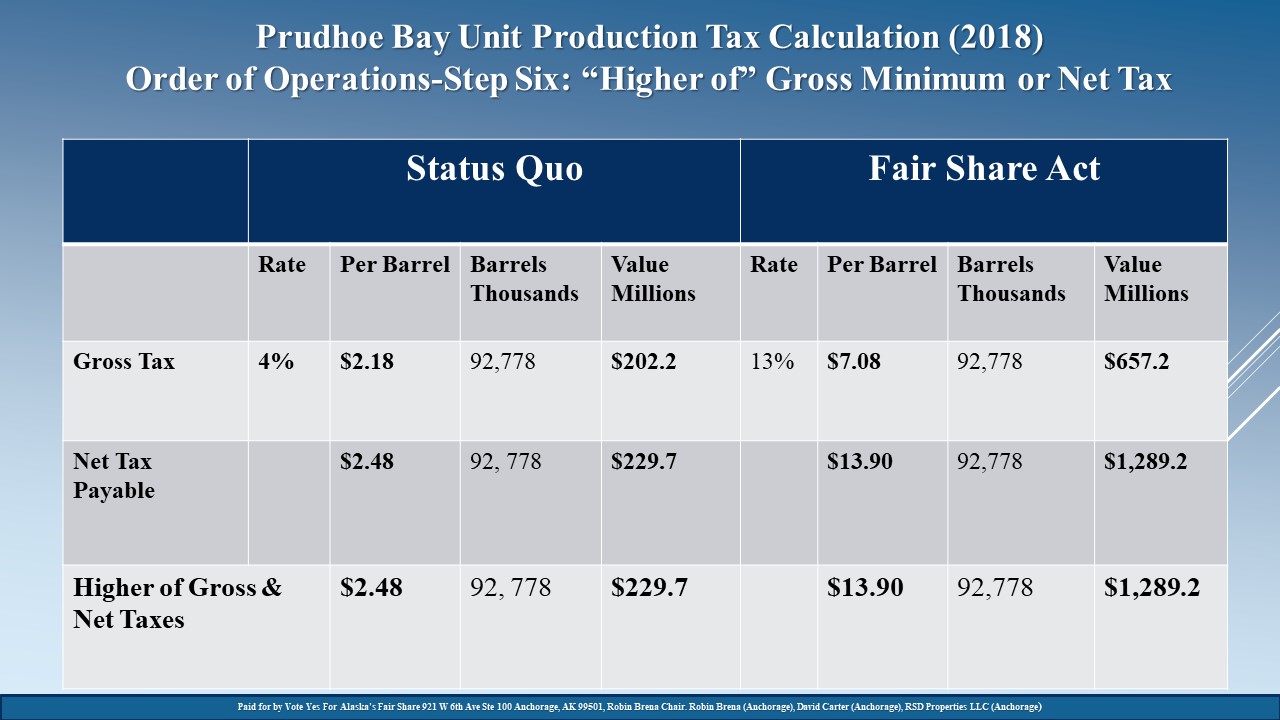

Order-of-Operations Slide 6: Step Six—Calculation of “Higher of” Gross Minimum Tax and Net Tax.

Order-of-Operations Slide 6 shows step 6 in the calculation of production taxes: the application of the “greater of” the gross minimum tax or the net tax. Production taxes are based on the “greater of” the gross minimum tax or the net tax.

Under SB21 for 2018, the gross minimum tax was $202.2 million and the net tax was $229.7 million. The “greater of” these two taxes results in the State collecting the net tax of $229.7 million under SB21.

Under Ballot Measure 1 for 2018, the gross minimum tax was $657.2 million and the net tax was $1,289.2 million. The “greater of” these two taxes would result in the State collecting the net tax of $1,289.2 million under Ballot Measure 1—$1,059.5 million more than under SB21.

To put this in context, the Prudhoe Bay Unit produced $3,683.5 million of net income after all expenses and royalties were considered in 2018. Under SB21, the State’s share of this $3,683.5 million was only $229.7 million in production taxes. Under Ballot Measure 1, the State’s share of this $3,683.5 million would have been $1,289.2 million.