Under SB21, Alaskans’ share has been anything but fair. SB21 has made a bad situation unbearable through providing artificially low production tax rates and unnecessary tax credits for our three largest and most profitable oil fields. Alaskans simply cannot afford to continue giving away billions of dollars in corporate welfare to major international oil producers.

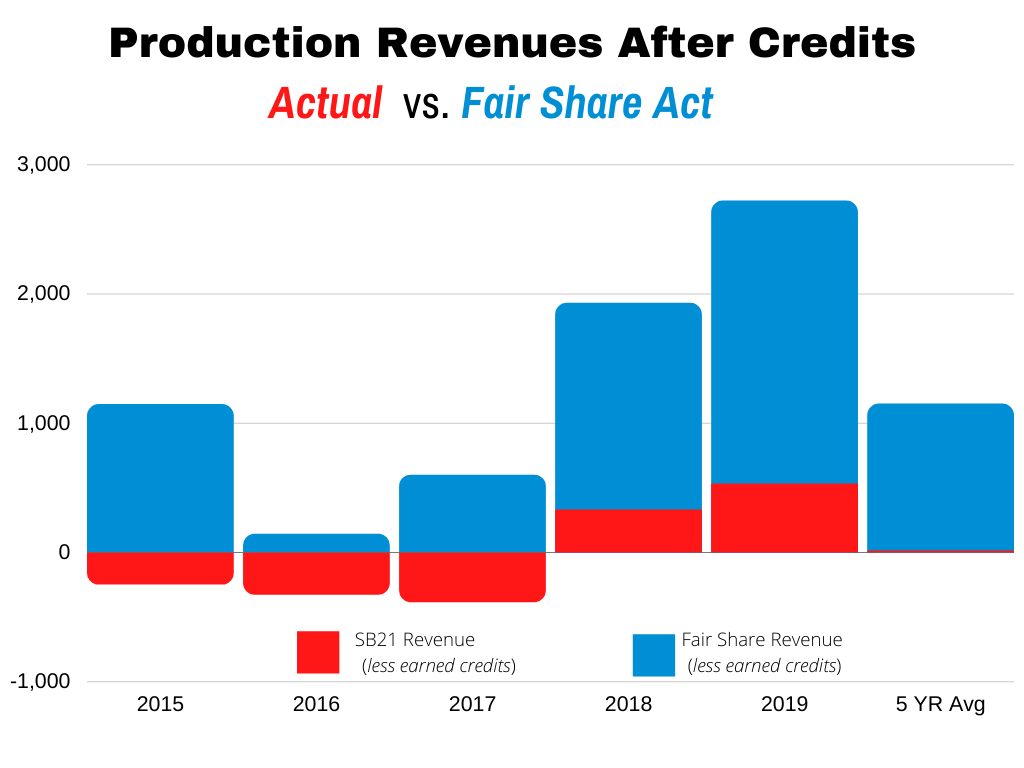

Let’s be honest about production taxes. Under SB21, Alaskans have received the lowest production taxes in our history and the lowest production taxes of any state or nation with major oil resources in the world. SB21 has more ways for the major international oil producers to avoid paying production taxes than Carter (a pill manufacturer) has got pills. In the five years before SB21, Alaskans received a total of $19 billion or $3.8 billion per year in production taxes after credits. In the five years after SB21, Alaskans received a total of negative $82 million or negative $16.44 million per year in production taxes after credits. Ironically, since SB21, we have paid the producers more to produce our oil in paid credits than they paid us in production taxes. If the Fair Share Act were in place for the last five years instead of SB21, Alaskans would have received a minimum of $5 billion or $1 billion per year in production taxes after credits.

[give_form id=”455″]