We have modeled Ballot Measure 1 with the actual historic data for the past five years since SB21 has been in effect. The actual historical data is publicly available from the Alaska Department of Revenue. Some of this data is in sources such as the Revenue Source book while other data comes from responses to public records requests made by Vote Yes.

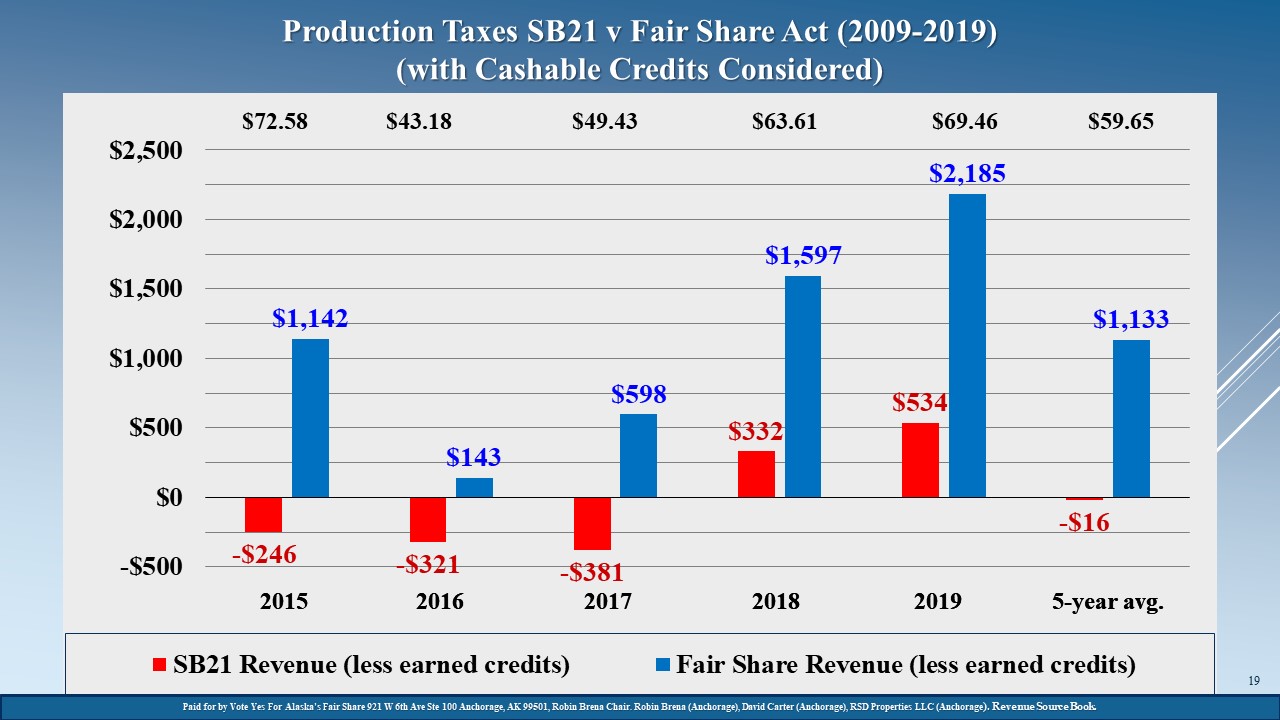

We wanted to capture how Ballot Measure 1 would perform under a range of economic and oil price conditions compared with SB21. This modeling is available for your review on our web page at alaskasfairshare.com/detailed-modeling. The Look-Back Slide 2 summarizes the results of that modeling and is set forth below:

Notes on Look-Back Slide 2:

Look-Back Slide 2 compares the production taxes with cashable credits considered for the five fiscal years (2015-2019) under SB21 (actual) and under Ballot Measure 1 (modeled by Alper). SB21 resulted in negative production taxes in three of the five years with cashable credits considered. When the price of oil was $72.58 per bbl. in 2015, for example, the net production taxes (including cashable credits) were negative ($246) million under SB21 and would have been a positive $1,142 million under Ballot Measure 1. The five-year average in production taxes with cashable credits considered was negative ($16) million under SB21 and positive $1,133 million under Ballot Measure 1 or a $1,117 million difference.

Look-Back Slide 2 demonstrates that under SB21 the State has paid more out in cashable credits than it received in total production taxes. It also demonstrates that over a range of oil prices and circumstances during the past five years, when back cast using the same DOR data, Ballot Measure 1 would have provided $1.117 billion per year more revenue than SB21.

Cashable credits are considered in this comparison, because, when evaluating the performance of the current tax system, it is important to consider both the amount the State paid and still owes in cashable credits and the amount the State received in production taxes. Although the cashable credit program has expired, the State continues to owe $738 million in cashable credits that it has not been able to pay as the result of the collapse of production taxes under SB21.

On average, Ballot Measure 1 would have resulted in $1.1 billion per year in additional revenue compared with SB21. Roughly two-thirds of the additional revenue is from eliminating the $8 per revenue-barrel credit for the Prudhoe Bay Unit.

Keeping $1.1 billion per year more of our oil wealth in Alaska is the economic equivalent of creating 11,000 new jobs at $100,000 per year. This $1.1 billion per year will also multiply through our economy as the additional revenue is spent within our economy. Typically, the multiplier effect is 5-7 times the new revenue, meaning $1.1 billion would have an economic effect of roughly $6-7 billion in the Alaskan economy.

To your point, these positive economic effects will occur in Alaska regardless of how the additional revenue is spent to reduce the State deficit. The Legislature will ultimately decide how the revenue should be spent, but whether it is spent to better fund PFDs and capital budgets or to save jobs directly in education, the marine highway system, universities, road maintenance, etc., the economic effect will be considerable.

Importantly, this positive economic effect from Ballot Measure 1 will keep $1.1 billion per year in Alaska that would otherwise leave and be spent out of Alaska. Obviously, keeping our share in Alaska is much better for the Alaskan economy than giving away our share and allowing it to be taken out of Alaska.

Let’s look at some of the ways BP and ConocoPhillips have chosen to use the additional profits resulting from SB21. They include pursuing the purchase of distressed assets in the Permian Basin, paying off the costs of the Deepwater Horizon disaster, paying down debt, buying back stock, and increasing stock dividends. SB21 profits are not being invested on the ANS; instead, they are leaving Alaska. Overall capital Investment on the ANS for past four years under SB21 has been the lowest level of capital investment in decades. While companies are free to invest their profits outside of Alaska if they choose, the people of Alaska shouldn’t be giving up their share to subsidize investments being made out of Alaska.

To offer a few specifics, since SB21, ConocoPhillips has made 68% of its world-wide net income from Alaska and only spent 15% of its world-wide capital in Alaska. While our PFDs have been cut to one-third, ConocoPhillips has increased its dividends by 60% in the last two years. While we have spent $18 billion of our savings, ConocoPhillips has paid off over $12 billion in debt and has paid billions more to repurchase its own stock. In fact, ConocoPhillips just announced it is repurchasing $1 billion more of its own stock before the end of this year and is exploring purchasing billions of dollars of distressed assets outside of Alaska. Not only was our share taken from us through SB21, it is also being taken out of Alaska.

While Ballot Measure 1 will help the economy of Alaska a lot, it is also important to note there will be a minimal negative impact from Ballot Measure 1 on the oil and gas industry because (1) Ballot Measure 1 does not apply to new and developing fields with more sensitive economics, and (2) our three major fields are highly-profitable fields that have operated for almost four decades with the demonstrated capacity to attract investment and provide operational jobs under higher production taxes than Ballot Measure 1 establishes. Ballot Measure 1 will actually lower the production taxes for our three major fields compared with the historic average before SB21.

Finally, the recent “study” by American Action Forum (AAF) concerning the loss of jobs in the industry if Ballot Measure 1 is passed is a press release by a “dark money,” anti-tax, political action group that conducted no original research. Alaskan journalist Dermot Cole has posted three articles on the AAF press release on dermotcole.com. In short, the AAF press release is seriously flawed, and the underlying studies it relies upon do not support AAF’s methodology, statements, or conclusions. It improperly (1) applied Ballot Measure 1 to all fields on the ANS when it only applies to our three major fields, (2) assigned a drilling impact to nondrilling operating costs for legacy fields, (3) ignored the benefits of additional production taxes, and (4) reached the opposite conclusions of the underlying studies it relied upon. The underlying studies conclude a state would be worse off lowering production taxes because the costs of production are inelastic to production taxes. This means the State should never have passed SB21, not that the State should keep SB21.

Following are four articles with greater detail of the general issues discussed above for your consideration:

What I hope to gain is a better future for our Alaskan families. If life-long Alaskans most familiar with these issues are not willing to stand up for what is fair for Alaska, the future of Alaska will be diminished. I have watched for six years while Alaskan families have suffered as SB21 has collapsed our economy and eroded the future of Alaska. All Alaskans should support amending SB21 through Ballot Measure 1 to make SB21 fairer and transparent.

Financially, I have nothing to gain and much to lose from being involved with Ballot Measure 1. I have spent my professional life as an attorney representing independent producers, oil service companies, transportation companies, and refining companies. My involvement with Ballot Measure 1 puts my ongoing legal practice at risk.

Politically, I have nothing to gain. I have no political ambitions and have turned down leadership positions within prior administrations.

Of course, explorers should look at the economics of the project over the entire life of the project. That said, the metrics used to evaluate the economics of new and developing fields like Pikka require modelling many factors, including profitability, reserves, contingent reserves and potential resources, permitting and execution risk, future oil prices, the cost of capital, and taxes and royalties. Given all these factors, a change in oil taxes after 10 years or more of production to a rate that is slightly less than the historical production tax has been over the last four decades is relatively minor.

Looking at just the NPV and expected returns for the Pikka field, assuming 600 million barrels of 44 degree API crude oil, a reasonable production ramp up to 120,000 bpd, any reasonable oil price forecast, and any reasonable discount rate (10-15%), the NPV and expected returns from the Pikka field are not significantly impacted by Ballot Measure 1.

When the Pikka field reaches 400 million barrels already produced and is still operating at over 40,000 barrels per day, it will have become a massive financial success for Oil Search and should be expected to then pay production taxes under Ballot Measure 1. The production taxes under Ballot Measure 1 are less than Alaska has collected on average for the last four decades. Ballot Measure 1 is more than fair when fields are new and developing as well as when they are fully mature.

In fact, a much greater risk is caused by the lack of tax stability that was created by the collapse of production tax revenue under SB21. The current structure benefits the legacy major producers with a very high NPV for established production. To companies such as Oil Search, this creates a greater risk of much higher future production taxes to cover the resulting State deficits.

Ballot Measure 1 also adds value to Oil Search by providing a better and more stable business environment and a higher quality of life for its employees in Alaska. Oil Search has a reputation of being fair with the resource owners impacted by the extraction of oil and gas resources from their lands. Oil Search’s enlightened position of cooperation and mutual benefit (rather than taking as much as political power will allow) is the best long-term position for Oil Search, its employees, and Alaska.

Unfortunately, Oil Search’s enlightened position is not shared by our largest producers. As a result, they have used their political power to take more than they should from Alaska. As a result, Alaska has not been able to manage its own financial affairs and has been driven into economic hardship ever since SB21 passed and well before the pandemic. Ballot Measure 1 helps address these financial issues and reduces the political risk faced by Oil Search in Alaska. Oil Search’s business plans with Pikka will be substantially politically and economically de-risked by the passage of Ballot Measure 1, and its employees will enjoy a more appropriate quality of life while in Alaska.

When discussing costs per barrel, I am referring to the costs per barrel of the three major oil fields to which Ballot Measure 1 will apply: the Prudhoe Bay Unit, the Kuparuk River Unit, and the Colville River Unit.

One of the main purposes of Ballot Measure 1 is to increase transparency with regard to the financial performance of our major oil fields so we can learn the actual costs per barrel for each of the major producers in each of our three major fields. Under current law, however, we may only request the collective costs of operating the Prudhoe Bay Unit. We have the actual lease expenditure reports for the Prudhoe Bay Unit from the Department of Revenue.

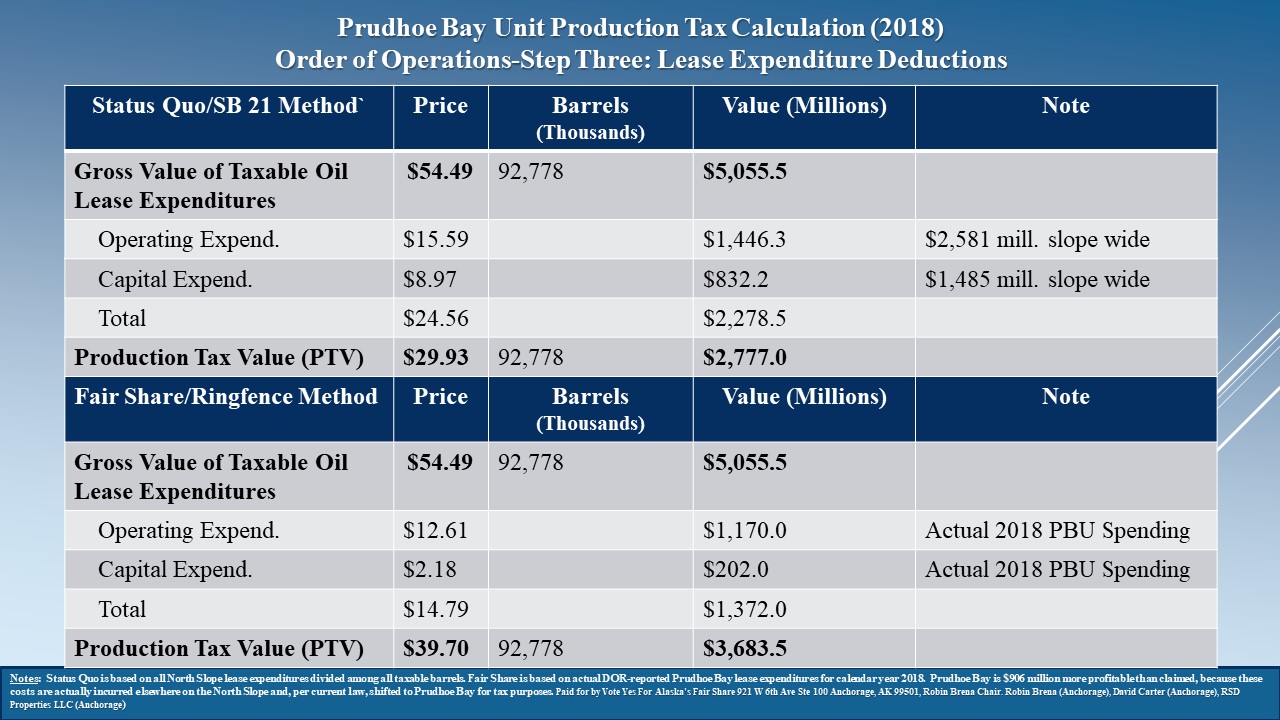

In our detailed modelling set forth at alaskasfairshare.com/detailed-modeling, we use the actual Prudhoe Bay costs in our order-of-operations slides calculating the production taxes for the Prudhoe Bay Unit for 2018 under both SB21 and Ballot Measure 1. The Order-of-Operations Slide 3 has the actual operating and capital costs for the Prudhoe Bay Unit in 2018. It is set forth below.

Order-of-Operations Slide 3

Notes on Order-of-Operations Slide 3:

Order-of-Operations Slide 3 shows step 3 in the calculation of production taxes: the deduction of lease expenditures from the Prudhoe Bay Unit in 2018. Ballot Measure 1 does amend SB21 with regard to the deduction of lease expenditures, so step three is significantly different under SB21 and Ballot Measure 1.

SB21 permits expenses unrelated to producing oil from the Prudhoe Bay Unit to be deducted from the calculation of production taxes from the Prudhoe Bay Unit. Specifically, SB21 permits the deduction of prorated ANS-wide expenses (that includes significant expenses unrelated to the Prudhoe Bay Unit) of $1,446.3 million in total or $15.59 per bbl. in operating expenses and $832.2 million in total or $8.97 per bbl. in capital expenses. Deducting expenses that includes those expenses unrelated to the Prudhoe Bay Unit results in production tax value in 2018 of $2,777 or $29.93 per bbl. under SB21.

Ballot Measure 1 limits the deductions to only those expenses that are related to the Prudhoe Bay Unit. This is sometimes referred to as “ring fencing.” Specifically, Ballot Measure 1 only permits the actual expenses related to the Prudhoe Bay Unit of $1,170 million in total or $12.61 per bbl. in operating expenses and of $202 million in total or $2.18 per bbl. in capital expenses. Limiting deductions to expenses related to the Prudhoe Bay Unit results in production tax value in 2018 of $3,683.5 or $39.70 per bbl. under Ballot Measure 1.

Allowing legacy producers to deduct expenses unrelated to the Prudhoe Bay Unit under SB21 significantly reduces the State’s production taxes, results in an unfair competitive advantage for legacy producers over new explorers, and exposes the State’ production taxes to substantial and unnecessary future risk or loss. For example, the State has calculated that ConocoPhillips’ spending in NPR-A will reduce the State’s production taxes by roughly $300 million per year for most of the next decade, and it is not clear whether or not the State may ever recover these lost revenues.

For 2018, the Prudhoe Bay Unit’s actual costs per barrel were (1) operating costs of $12.61 per bbl., (2) capital costs of $2.18 per bbl., and (3) transportation by pipeline and tanker costs of $9.12 per bbl. or $23.91 per bbl*.

In 2018 in the Prudhoe Bay Unit alone, the producers made $3,683.5 million or $39.70 per barrel in net income. SB21 gave $8 per-revenue barrel in credits, which totalled $742.2 million for Prudhoe production. As a result of the credits, the production taxes due from Prudhoe were reduced from $971.9 million to $229.7 million.

*As a side note, the $9.12 per bbl. in transportation costs are detailed in Order-of-Operation Slide 2. The transportation costs deducted have profits and unpaid tax allowances transferred among affiliates of roughly 25% imbedded in them, so the true costs of transportation are closer to $6.84 per bbl. for 2018.

Ballot Measure 1 only applies to the three largest and more profitable fields in Alaska that have been operating for decades and can well afford to pay a fair share to Alaskans.

When considering viability, one much consider both the viability of the State and the viability of the producers impacted by Ballot Measure 1 in our three major fields.

Under SB21, the State is simply not viable in the long-term. Ballot Measure 1 seeks to find a fair balance between the State and the producers in our three major fields.

As a practical matter, Ballot Measure 1 should not impact the viability of the producers in our three major fields because it levies a fair tax compared with our historic average taxes, our sister oil State’s historic and current average taxes, and foreign resource owners’ historic and current average taxes. After Ballot Measure 1 passes, the producers in our major fields will be making more and paying less in production taxes to Alaska than is available to them from any other major resource owner in the world. In fact, ConocoPhillips’ annual reports and the Legislative Research Report analyzing ConocoPhillips’ annual reports both demonstrate that ConocoPhillips makes over twice as much per barrel Alaska-wide than in either the Lower 48 or internationally. If this is true Alaska-wide, then the margins are even greater in the low-cost, high-profit major fields.

With regard specifically to our three major fields, those fields have paid higher production taxes than Ballot Measure 1 for decades prior to SB21 with no impact to their viability. During these decades before SB21, the producers in our three major fields were able to attract capital and made considerable profits. There is no reason to believe Ballot Measure 1 will impact the viability of the producers in our three major fields, but it is clear that SB21 has negatively impacted the viability of the State considerably.

Ballot Measure 1 will become law 90 days after the vote is certified.

The actual ballot measure is two pages long, fairly simple, straight forward, and available to read at our website. The Legislature may pass a substantially similar bill but may not amend Ballot Measure 1 to be inconsistent with its intention for two years.

With the assistance of a State Senator, we proposed SB129 to avoid any possible confusion as to the sponsors’ intention. SB129 is in the proper legislative drafting form and is substantially similar to Ballot Measure 1.

We have also provided detailed comments and modelling by the former Tax Director for the Division of Revenue on our web page as to exactly what the sponsors of the initiative intend and how the bill works so as to eliminate any question as to how it mechanically should be applied.

We met with senior management of Exxon, ConocoPhillips, and Oil Search early in the process to answer any questions they had and to listen to their concerns with regard to the meaning and intention of Ballot Measure 1.

We have spoken to over 40,000 voters to obtain their signature to place it on the ballot and provided clear information to them as to what is intended. We have spent over $1 million reaching out to all Alaskans concerning Ballot Measure 1. We have met with civil groups, associations, and companies in Alaska to explain Ballot Measure 1.

We have written extensive opinion pieces explaining in detail the oil policies underlying Ballot Measure 1 and how it works. We have briefed and sent detailed explanations to every Legislator. We offered and were declined the opportunity to meet with the Legislative committees and its retained expert when it held the required hearings on Ballot Measure 1. We offered and were declined the opportunity to meet with the Attorney General and the Lieutenant Governor to discuss their confusing and contradictory opinion and summary of Ballot Measure 1.

We subsequently successfully litigated the confusion caused by the Attorney General’s and the Lieutenant Governor’s contradictory opinion and summary to the Alaska Supreme Court. We also subsequently and successfully litigated against false and confusing claims raised by industry groups financed by the major producers to the Alaska Supreme Court. We have successfully explained to the Alaska courts on four separate occasions the sponsors’ intentions under Ballot Measure 1.

We have been in several live and recorded debates as to the sponsors’ intention. We have participated by drafting a summary and a statement for the ballot booklet and engaged in public hearings in each of the four judicial districts of Alaska in debate with those opposed to our position.

We have responded to the most expensive misinformation campaign directed at an initiative in Alaska’s history funded by the major producers by explaining in detail how Ballot Measure 1 actually works.

And, after Ballot Measure 1 passes, we are willing to explain any possible issue of confusion to the Legislature or to the Department of Revenue as regulations are drafted.

We believe Ballot Measure 1 is simple and clear, and any remaining confusion is the result of the extensive and intentional effort by the major producers to defeat it and continue to avoid paying a fair share for Alaskans. We are not aware of anything else we could have done to avoid unintended consequences arising from Ballot Measure 1. Should it pass, we plan to continue to be diligent to ensure the intention of Ballot Measure 1 is not lost through the efforts of those opposed to it.

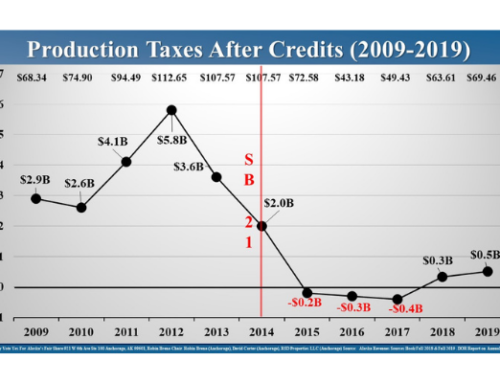

Our net production revenues (with credits considered) went from an average of $3.8 billion per year down to zero when the price of oil only declined by 35%. I don’t assert that a 35% drop in oil price should result in an identical 35% reduction to production taxes, but I do assert that a 35% drop in oil price does not explain the complete collapse of our net production taxes down to zero.

The predominate role of SB21 in the collapse of our petroleum taxes is obvious in several observations. In 2013 (before SB21) and 2014 (six months of which were under SB21), the price of oil remained identical, but we recovered $1.6 billion less in 2014 when SB21 had been in effect for only six months. Comparing all years when the price of oil was substantially the same before and after SB21 reveals that after SB21, our production taxes were one-fourth to one-sixth as much as before SB21. So, it is SB21 and not a decline in the price of oil that explains most of the collapse to our production taxes since SB21.

The major reason that SB21 caused the collapse of our production taxes is the $8 per revenue- barrel credits being given for existing production from our three major fields. After SB21, investment in the Prudhoe Bay Unit declined to 25% of the investment before SB21, and production continued to decline. Nevertheless, SB21 awards $8 per revenue-barrel credits that are almost four times more than the amount actually invested in Prudhoe ($742.2 million in credits and $202 million in investment). SB21 credits are simply corporate welfare and were provided for oil that would have been produced without any credits, and, in fact, had been produced without any credits for over three decades. SB21 credits are simply not sustainable, and any fair person would admit it. These massive and unnecessary credits collapse our petroleum revenues by reducing the net calculation down to the 4% minimum gross calculation, which dramatically under collects a fair share for Alaska.

When the price of oil went down 35% between the five-year period before to after SB21 was passed, our sister oil states recovered through combined royalties and production taxes roughly 28-35% of gross while Alaska recovered 12.5% of gross or less than half as much as other States.

Yes, that would be helpful, but each method of comparison helps highlight the issue from a slightly different perspective. In our detailed order-of-operations slides, we have compared SB21 with Ballot Measure 1 with regard to the calculation of production taxes for the Prudhoe Bay Unit based on the historic data for 2018. In our detailed look-back slides, we have compared SB21 with Ballot Measure 1 for the past five-year period for the ANS based on historic data. These slide sets are set forth at alaskasfairshare.com/detailed-modeling. We have compared SB21 with Ballot Measure 1 in other analyses on a total-revenue basis, on a per-barrel basis, on a percent-of-gross basis, and on a per-barrel basis in similar oil price environments.

Also, while the changing volume profile has some impact, it plays a minor role in explaining the complete collapse of our production taxes under SB21. The actual structure of SB21 that permits massive $8 per revenue-barrel credits against our production taxes from our three major fields has the predominant role in the collapse of our production taxes. To use the Prudhoe Bay Unit in 2018 as an example, the $8 per revenue-barrel credits reduced our production taxes from $971.9 million to $229.7 million.

Comments:

The purpose of the slide is to make the point that our combined royalties and production taxes for the three major fields impacted by Ballot Measure 1 are less than ever in our history and considerably less than our sister oil States with whom we once had parity. Even assuming all the leases in our three major fields were at 16.67%, the point would still be true. The combined royalties and production taxes have averaged 27% of gross since production began on the ANS to the enactment of SB21. Governor Palin averaged 38% of gross. North Dakota, Texas, and Louisiana are in the 29-35% of gross range. Since SB21, Alaska has only collected 12.5% royalties (or slightly higher given your point that some newer leases in the three major fields are at 16.7%)—either way, it is less than half of what we used to collect or what our sister oil States are now collecting.