Do not listen to the same broken promises and expect the future to be different.

The recent article by Rep. Jason Grenn requires rebuttal. Grenn’s comprehension of the Fair Share Act — Ballot Measure 1 — is so awful that his piece was a gross disservice to the Clarion readers. Grenn claims he does his research. But Grenn never picked up the phone and talked with us.

This is a real shame since Robin Brena was one of Grenn’s top supporters and Robin would have accurately answered Grenn’s questions. But facts get in the way of an agenda. Grenn’s agenda appears to be to ensure Alaskans lose their dividends and pay an income tax so that we can pay Big Oil corporate welfare.

Grenn makes false assertions about things we’ve never said, then attacks. This is a classic straw man argument. Accuse someone of saying something they never said, then condemn them.

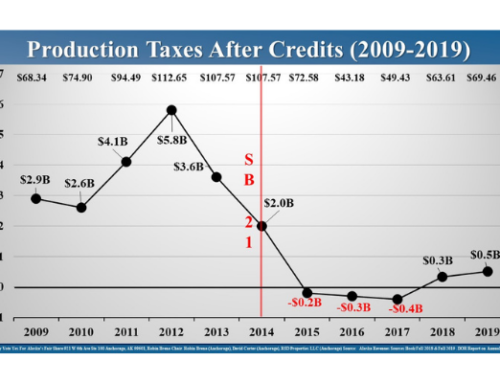

Grenn’s most erroneous assertion is that SB21 isn’t a fiscal disaster. The objective fact is that Alaska paid more in awarded credits (corporate welfare), $2.1 billion, then we’ve received in production tax revenue, $2.0 billion, from 2015-2019.

Because Alaska received $0 in production tax revenue, the Legislature reduced your dividends over the last half decade by about $7,000 each. That’s been a $28,000 loss to a family of four, or about a $5-billion-dollar loss to all Alaskans.

The Legislature also has also spent almost $18 billion from our savings to subsidize the massive deficits created by SB21. Those savings are now gone and the Permanent Fund earnings reserve is disappearing. The next Legislature will try to impose new taxes on Alaskans to deal with an estimated a $2.3 billion dollar deficit, a deficit is so large it works out to about $3,000 per Alaskan. Alaskans are also on the hook to the tune of about $1,000 each for the older, awarded credits that the Alaska Supreme Court said could not be dealt with through bonding.

What did Grenn do to solve this looming fiscal disaster when he was a legislator? He voted to spend our savings and not fund full dividends. Grenn failed to solve our fiscal problem.

Now he spews misinformation about Alaska getting its fair share for our oil. The Fair Share Act followed Alaska’s Constitutional procedure but he and other legislators failed to conduct substantive hearings on it or on any solution to address Alaska’s fiscal crisis. Some leader.

Ken Alper, the former head of Oil and Gas Division of the Department of Revenue for the state, has modeled the amount of revenue the Fair Share Act will bring Alaska. In normal times it should bring in about $1.1 billion per year. Over the five years, it accumulates to more than $5 billion — with annual revenue about half of the FY 2021 projected deficit.

Grenn is flat wrong to suggest (passage of) the Fair Share Act is not a critical step that we must take. But Grenn’s logic is unfathomable; he failed to even attempt to get accurate information. Grenn is satisfied with no solution to a failed production tax system where Alaska pays more in corporate welfare than we gain in production tax revenue. Instead, Grenn wants to continue to subsidize Big Oil and do so on the backs of Alaskans. Unfortunately, his “solution” also results in the likely end of the dividend program.

If Grenn wants to describe SB21 as a success, then he should not mix up various numbers to make his argument. He should explicitly articulate what all Alaskans were promised in 2013 when oil company employed-legislators passed SB21.

Those promises? One million barrels per day of TAPS production. Production is now less than 500,000 barrels per day. We were promised more jobs. Instead, we have thousands fewer jobs and of those over one-third are not Alaskans — just more broken promises. As for production revenue, its vanished. Alaskans were promised more investment but our legacy fields saw substantially reduced investment. Do not listen to the same broken promises and expect the future to be different than the current crisis.

Dr. Robin Brena recently prevailed at the Alaska Supreme Court, twice. Those were hard-fought victories that prevented Big Oil from keeping Alaskans from having a chance to vote, and preventing the lieutenant governor from printing ballots with false, or misleading information about Ballot Measure 1. Yes, the lieutenant governor is one of the former ConocoPhillips, conflicted, employees who voted in the Senate to approve the disastrous SB21.

Please vote “yes” on 1 to restore fiscal sanity — or pay an income tax, lose your dividend, and watch the Alaska economy continue to crumble.

Merrick Peirce of Fairbanks is one of the three prime sponsors of the Fair Share Act along with Robin Brena and Jane Angvik. Peirce is the former CFO and board member of the Alaska Gasline Port Authority. He served Gov. Sarah Palin on the Department of Revenue Transition team and Gov. Bill Walker’s transition team on energy. Peirce is also a ConocoPhillips shareholder.