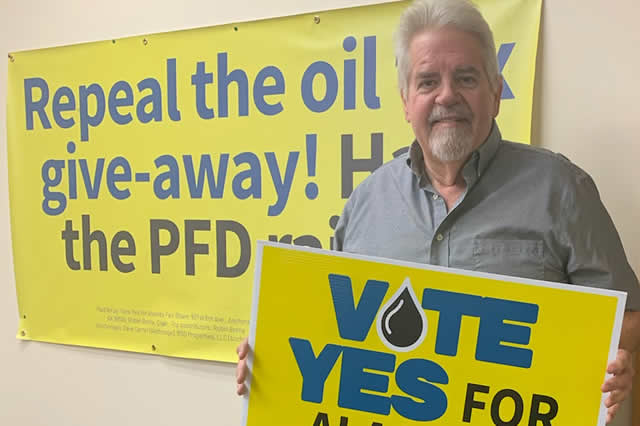

‘I am supporting Vote Yes for Alaska’s Fair Share for the following:

People supporting SB21 (current tax structure) did so to encourage the oil industry to invest more to increase production. According to an article in the Anchorage Daily News, April 9, 2013,

“…The companies that operate on the North Slope say the aging oil reserves have been undergoing “normal field decline,” most of which happened before ACES was adopted in 2007. But that’s not how Kelly (State Senate President Pete Kelly) sees it: “When ACES was enacted, Alaska was producing about 700,000 barrels per day per year. Now we only produce around 550,000… “We either fix our tax system, or we suffer the consequences.”

“Sen. Mike Dunleavy, another member of the powerful Senate Finance Committee, has asked why ACES was created in the first place. The tax structure was overhauled in 2006, but then was tweaked again in 2007, resulting in ACES…

… Was ACES created to raise more tax dollars for Alaska? Was it to punish oil companies for the oil tax created in 2006 during the taint of lawmaker-oil bribery scandal? Was ACES designed to increase oil production?

… If ACES was to raise money, it may have worked, he said. If it was to punish the companies, maybe that worked, too. If it was to increase production, then ACES wasn’t successful.”

Alaskan’s ultimately approved SB21 lowering our revenue with the anticipation that oil companies would increase production. For whatever reason, the oil companies have not achieved increased oil production and in fact, oil production has decreased. Yearly oil production has continually decreased from 187,406,088 bbl in 2014 to 178,983,638 bbl in 2019.

Based on the above facts, we must pass Vote Yes For Alaska’s Fair Share in order to get our fair share.’