~ By Les Gara

June 4, 2020

I believe in an Alaska we want to live in, not leave. And that’s why fair oil reform, by removing excessive oil company tax breaks on our three most profitable, largest oil fields needs to be part of a solution to Alaska’s staggering fiscal crisis. If not, the things we believe in – whether you’re personally a supporter of quality public schools; a strong University that can train and educate Alaskans; needed construction jobs; Permanent Fund growth; support for seniors; or, basic services – will be subjected to continued risk and damage.

I believe in an Alaska we want to live in, not leave. And that’s why fair oil reform, by removing excessive oil company tax breaks on our three most profitable, largest oil fields needs to be part of a solution to Alaska’s staggering fiscal crisis. If not, the things we believe in – whether you’re personally a supporter of quality public schools; a strong University that can train and educate Alaskans; needed construction jobs; Permanent Fund growth; support for seniors; or, basic services – will be subjected to continued risk and damage.

Giving money away to large, influential corporations with one hand, and taking it away from Alaskans with the other is not fair or wise.

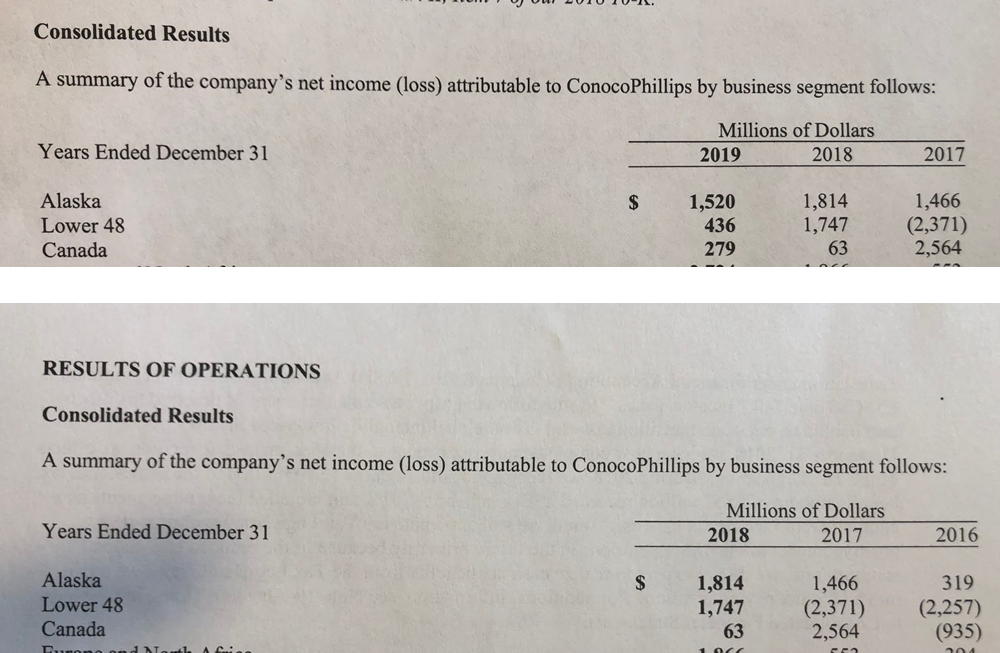

A look at publicly available major company oil profits in Alaska tells us that fair oil revenue is needed as part of a fiscal plan. It will leave Alaska more than competitive with the Lower 48 states and Canada.

| Corporate Profits (Millions of Dollars) Numbers in ( ) indicate losses |

||||

|---|---|---|---|---|

| Years ended December 31 | 2019 | 2018 | 2017 | 2016 |

| Alaska | $1,520 | 1,814 | 1,466 | 319 |

| Lower 48 | 436 | 1,747 | (2,371) | (2,257) |

| Canada | 279 | 63 | 2,564 | (935) |

Source: ConocoPhillips 2018 and 2019 Annual Reports

Publicly available oil company profit reports by Alaska’s largest oil producer – ConocoPhillips – help show we’ve been exorbitantly generous to large oil producers at the expense of Alaskans. Conoco is an owner of the three fields (legally called “units”) covered by this Initiative.

They show Alaska has provided more profit over the last four years to the oil companies affected by this Initiative than all the Lower 48 states and Canada COMBINED.

A corporation’s statutory legal obligation is to maximize the profits for their investors, not to pay a fair share to us. That’s our job. So, let’s talk about what they’re hiding in their high-cost TV and radio ads.

No Other Significant Sources of State Revenue Until 2023 at the Earliest

At the outset, there’s a glaringly important reality to consider for those Alaskans who seek a personal tax. Though we Alaskans still disagree on the adoption of personal taxes, that’s a moot point for the near term. The only significant revenue available for a vote and adoption this year is the Alaska Fair Share voter initiative.

Even were the Governor and Legislature to change course and adopt an income or sales tax next year, that law would take a year and a half to implement according to state revenue officials. It couldn’t produce any revenue until 2023 at the earliest, after more damage has been done, more jobs have been killed, more teachers have been lost, and no savings remain. Additionally, no personal tax can alone fill our fiscal gap.

Wait for that, and you’ll just watch while people rearrange the chairs on the Titanic.

This November: The Fair Share Voter Initiative

The Fair Share Act eliminates unjustified tax breaks in favor of a tax structure that’s still more attractive than what companies pay in the major Lower 48 oil producing states.

The Statehood Act gave Alaska’s oil on state lands to the public so we could, as our Constitution says, have the needed funds to provide the “maximum benefit” possible to our citizens.

Our oil industry partners are an important part of our economy. But now Alaska is a junior partner under the unjustified, unaffordable tax breaks we give to some of the largest oil companies in the world.

Public Reports: Alaska More Profitable Than All Lower 48 States Combined.

ConocoPhillips is the only oil company operating in Alaska required by federal securities laws to reveal their Alaska profits. These reports show ConocoPhillips made more profit in Alaska the past four years than in all the Lower 48 states PLUS Canada COMBINED. Prior year reports tell a similar story.

In appearances before the Legislature, I and others have asked repeatedly for Exxon and BP’s profits when they ask for tax favors, and every time, they’ve said they have the right to hide them. Sort of a, “give us a few billion dollars in breaks, shortchange Alaskans, and we won’t show you our billions in Alaska profits” approach.

The Fair Share Act will also stop that practice allowing oil companies to hide their Alaska profits.

Reasons Alaska is More Profitable than North America’s Other Largest Oil Producing Regions.

Alaska’s fields are bigger and far more profitable at lower prices than shale oil, which dominates much of the Lower 48’s on shore state production. Conoco’s Annual Reports show they, like other oil companies, were willing to endure billions in losses in the Lower 48 for multiple years, knowing they make money at higher prices. In the oil business companies know prices shift between high and low.

Oil prices tripled between late April and late May. Experts have variously predicted $140/barrel oil, $110/barrel oil, and low-price oil, and at times all of them have been right. Most of them, as proven by history, will be wrong in the future. That is the oil business. Invest for the high-profit years and the long-term, knowing there will be low price years too.

While ConocoPhillips’ Reports show years of $1+ billion losses in the Lower 48 in 2016 and 2017, which companies tolerate with an eye on high profit years, those same Annual Reports show Alaska is a much more profitable region to do business.

ConocoPhillips made over $5 billion in oil profits in Alaska between 2016 – 2019, and had no unprofitable years. They tell you Alaska is a scary place to do business, to force us into unjustified tax breaks. That’s their job. But the facts show we’re a safe, high profit place to do business. Prudhoe Bay is the nation’s largest on shore oil field.

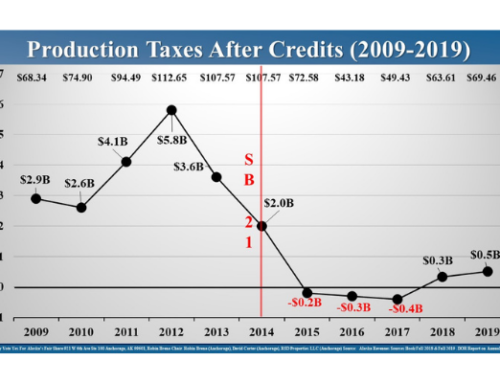

Not only are Alaska’s conventional oil fields large, but here’s the other rub that requires we pass the Fair Share Act. Large companies pay far more to produce less profitable oil in the Lower 48. In all states the two major payments for producing oil are the Oil Production Tax and the royalty.

Comparisons Show Alaskans are Being Severely Shortchanged.

Oil Taxes and royalty payments to the State of Texas on state lands are 30% of the value of all oil produced.

In North Dakota, where most royalties are paid to private landowners (Alaska is the land and royalty owner for most Alaska oil production), combined Oil Production Tax and royalty payments range from 25% – 35% or more (private landowners charge Royalties that normally range between 15% – 25%, and the North Dakota Production Tax adds an additional 10% – 11% on top of that, for a total 25%-36% payment depending on the field).

North Dakota also has state lands where the royalty is paid to the state. That state Royalty, depending of field profitability, ranges from 16.67% to 18.75%, for a total oil company payment of 26.67% – 29.75% of the value of the oil produced. So, depending on whether it’s private or state land, company payments in North Dakota range from 26.67% to 35% of the value of oil produced.

In Louisiana that rate is slightly higher – a 12.5% production tax, and an average 21.9% royalty (rates vary between fields), totaling a 34.4% payment for producing oil in that state.

Alaskans receive a roughly 50% – 100% LOWER combined Production tax and royalty payment at recent prices. At June 1, 2020 prices, the combined tax and royalty payment in Alaska is roughly 16% (a roughly 4% production tax plus a 12.5% royalty).

So:

Alaska 16%

Louisiana 25% – 34.4%.

North Dakota 26.67% – 35%

Texas 30%

The disparity is larger on Lower 48 oil on private lands. Private landowners tend to cut a tougher deal on royalties than many state governments. In testimony before the Alaska Legislature in 2017, when the House passed an oil tax reform bill that Senate President Pete Kelly blocked, the evidence was that in the major oil producing Lower 48 states, royalty payments to private landowners ranged from 15% – 25%, on top of state production taxes.

What The Fair Share Act Does: Modest Change on Only the Three Largest Fields

If voters approve the Fair Share Act, Alaska’s 12.5% royalty and new 10% tax rate will combine for a 22.5% payment at this year’s prices (through June 1).

That’s still lower than the 25% – 35% they pay to produce oil in major oil producing states in the Lower 48.

ConocoPhillips’ Annual Reports show Alaska oil on the three fields this initiative applies to is more profitable than fields in the Lower 48.

The fields this law would apply to are Alaska’s 3 largest oil fields, or technically “units” – Prudhoe Bay, Kuparuk and Alpine/Colville River. Between 2016 – 2019 Conoco’s reports show Alaska was profitable every year.

In 2016 and 2017 ConocoPhillips lost $4.5 billion on its Lower 48 operations because higher cost, smaller fields in the lower 48 require higher prices to be profitable.

For the most recent 4 years ConocoPhillips’ Alaska Profits totaled $5.119 billion. In those same years they lost $2.445 billion in all the Lower 48 states combined.

In Canada they made a profit of $1.97 billion for those years, or 60% less than they earned in Alaska. Alaska was roughly $5.5 billion more profitable than all the rest of North America combined for ConocoPhillips.

Exxon, BP and the other companies that produce in Alaska keep their profits hidden. But all three of them are co-owners at the nation’s largest, most profitable oil field, Prudhoe Bay. Conoco’s annual reports show we are giving away unnecessary tax breaks to the detriment of Alaskans.

You may hear this Initiative can apply to other fields as well. That’s not true for any other producing field in existence today. It applies only to the three biggest units in Alaska.

If many years into the future a blockbuster Alaska field is developed, that field, only if it is BOTH large, AND only after it has produced 400,00,000 barrels of oil (many years into production), would be subject to the tax rate under this act. The same point applies. This bill only applies to the largest, most profitable oil producing units. A modest 10% tax rate at current prices (which can rise to 15% at high, more profitable prices). Combined with our royalty, that’s still a bargain compared to the Lower 48.

The Fair Share Act Will Help Build A Vibrant Alaska

The question we should ask is what kind of Alaska we want to live in. Passage of the Fair Share Act will help end Alaska’s system of self-imposed poverty. The status quo jeopardizes our schools, public safety, dignity for our seniors, opportunity for our youth, our ability to create construction jobs and build an economy, and the growth of our Permanent Fund.

There is no other rational way out of our budget crisis before 2023. Let’s vote YES because it’s fair, it’s the right thing to do, and it’s the only thing we can do to close our deficit without hurting students, seniors, our economy, or risking the Permanent Fund. We kick the can down the road at our peril.

Sources: ConocoPhillips 2018 and 2019 Annual Reports