by Robin Brena

Part One

As owners, we Alaskans are entitled to one-third of the gross revenues from the sale of our oil. We realize our fair share through a combination of revenues from a production tax, royalty payments, income taxes and real property taxes. Production taxes are the most critical. In 2012, for example, production revenues were responsible for $6.1 billion (60 percent of total petroleum revenues).

Our production tax is broken and no longer helps us realize our fair share as owners. In 2017, production revenues will be only $0.1 billion (8 percent of total petroleum revenues). This article will discuss our current production tax, how to fix it and how to test if it is working.

CONSTITUTIONAL OBLIGATION

Article 8, Section 2 of the Alaska Constitution provides, “The legislature shall provide for the utilization, development, and conservation of all natural resources belonging to the State, including land and waters, for the maximum benefit of its people.” Thus, our Legislature has a constitutional duty to provide the maximum benefit for all Alaskans from our oil. The production tax is the primary manner in which the Legislature has historically undertaken to fulfill this constitutional duty.

THE DEAL

The late Jay Hammond was our governor from 1974 through 1982 — the period when the Trans-Alaska Pipeline System and much of the infrastructure for the production of our major legacy fields were built. Hammond was perhaps the single person most familiar with the original deal under which our oil resources came into production.

Hammond was clear what portion of our oil resources represented our fair share as owners. To quote him directly from the chapter “A Broken Bargain” from his book “Diapering the Devil,” “When I was in office, the state, the oil companies, and the federal government agreed to split the oil wealth pie roughly one-third, one-third, and one-third.”

When Alaskans received less than one-third of the gross value for our oil, Gov. Hammond believed Alaskans were being “shortchanged hundreds of millions of dollars each year for the past several years and will continue to be denied what was once agreed to be our ‘fair share.’ ” The year he said Alaskans were being “shortchanged” was 2004, a year when he calculated Alaskans received only 27 percent of the gross revenues from the sale of our oil.

The production tax is the primary means through which we are able to realize our fair share as owners. When considered with the other mechanisms for the recovery of our fair share, the production tax should be adjusted so the total net petroleum revenues equal one-third the gross market value of our oil.

HISTORY OF PETROLEUM REVENUES

Since 1978, Alaska has exported crude oil with a gross market value of $527 billion and received $141 billion in petroleum revenue — or 27 percent of gross revenue. Stated differently, from 1978 to date, we have undercollected our one-third ownership share by $35 billion — or 6 percent of gross revenue. This overall undercollection was what Hammond was referring to when he said Alaskans were being “shortchanged.” This undercollection is primarily due to the failure of the production taxes to recover our fair share as owners.

COLLAPSE OF PETROLEUM REVENUES

Our petroleum revenues have completely collapsed, and Alaskans are getting less for their petroleum resources than at any time in our history. Total net petroleum revenues from all sources have collapsed from $9.2 billion (2012) to $0.8 billion (2017) — or by 91 percent. The total net unrestricted petroleum revenues (which may be more readily used to reduce the massive current deficit) have similarly collapsed from $8.1 billion (2012) to $0.2 billion (2017) — or by 98 percent.

FAILURE OF THE PRODUCTION TAX

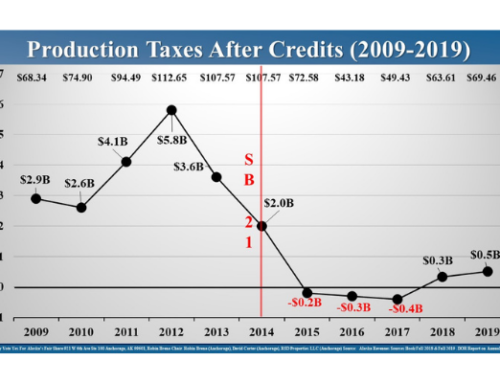

A primary reason for this collapse in petroleum revenues is the failure of the production tax to realize our fair share as owners. Total petroleum revenues under our production tax have collapsed from $6.1 billion (2012) to $0.1 billion (2017) — or by 98 percent. Net petroleum revenues under our production tax have collapsed even more, from $5.4 billion (2012) to -$0.5 billion (2017) — or by 109 percent. This decline in net petroleum revenues under the production tax is illustrated in the chart below:

For the first time in our history, Alaskans are paying the producers to produce our crude oil under our production tax. Our production tax is not even bringing in sufficient net revenues to timely pay the petroleum credits we are incurring under it.

Some choose to attribute this entire revenue collapse to the decline in the price of crude oil. As the price of crude oil declines, so will gross revenues and our fair share of those gross revenues. Unfortunately, revenues under the production tax declined much more than the decline in the price of crude oil. Our net production tax revenues declined from $5.4 billion (2012) to -$0.5 billion (2017) — or by 109 percent while the price of crude oil only declined from $112.65 per barrel (2016) to $43.18 per barrel — or by 62 percent. If our net production tax revenues had declined proportionally to the decline in the price of crude oil, the $5.7 billion in net production tax revenues would have declined 62 percent to $2.2 billion rather than to -$0.5 billion.

In 2016, Alaska produced 531,500 barrels per day at an average price of $43.18 per barrel (ANS West Coast) — or $8.4 billion in total gross market revenues. Our share of this $8.4 billion should have been one-third of the gross market value — or $2.8 billion. Instead, we recovered a net of $0.9 billion (total petroleum revenues from all sources less credits incurred) — or $1.9 billion less than our fair share as owners. Stated differently, collecting one-third of the gross market value for our crude oil through an appropriate production tax would have increased our petroleum revenues by $1.9 billion and cut our deficit roughly in half.

HOW BEST TO FIX THE PRODUCTION TAX

There are several ways to improve our current production tax, and I have detailed them in prior articles and testimony.

In general, going to a simple progressive gross-market tax with adjustments upward for the lower-cost major legacy fields and downward for the higher-cost minor fields would be the best solution.

If the Legislature is unable to adopt the best solution, the existing production tax could be improved through simply (1) raising the minimum tax for the Prudhoe and Kuparuk fields; (2) hardening the minimum floor so credits, new oil designations and loss carry-forwards may not avoid it; (3) restricting the definition of new oil and eliminating Point Thompson from the definition, (4) requiring and resourcing timely audits coupled with appropriate interest on underpayments, and (5) eliminating unnecessary credits while paying the necessary credits. That said, Alaskans have always gotten and will always get the short end of the stick under the complex revenue system we have in place today.

A SIMPLE TEST

Under any approach to fixing the production tax, the primary test to determine whether it is working is simple. If the production tax when added to our other sources of petroleum revenues (royalty, income and property revenues) results in Alaskans receiving one-third of the gross market revenue from the sale of our crude oil, then the production tax works. To apply this test is also simple: Multiply the barrels of crude oil produced in a year with the ANS West Coast price and divide by three. Then, check to be sure the revenues we received from all sources (production, royalty, income and property) equal this one-third.

Part Two

In Part One of this commentary, I explained the collapse of our production tax structure and suggested ways to correct and test it to be sure it is working. Here in Part Two, I will directly address the primary arguments suggesting we should take less than our fair share.

INEFFICIENT STATE SPENDING

Some suggest we should take less because the state government is spending wastefully. Alaskans should disagree. As the owners of our oil, we should recover our fair share whether the state spends wisely or foolishly.

OVER-TAXATION

Some suggest the oil industry is being overtaxed. Alaskans should disagree. Alaskans are entitled to a one-third fair share as owners of the oil ‒ getting our share is not a taxation issue but a question of ownership and stewardship.

HEALTH OF THE MAJOR PRODUCERS

Some suggest we take less for the health of three major producers. Alaskans should disagree. The three major producers have made and are continuing to make substantial profits from our oil while we forgo billions of our fair share as owners and spend billions of our savings. It is time for our primary concern to turn to the health of the state, the economy, independent producers, and other industries.

Moreover, property-related taxes, such as a production tax, should be paid regardless of claimed profitability. This is why every other oil state has a production tax based on gross revenues rather than on net revenues.

We also need sufficient petroleum revenues to efficiently support a viable and competitive oil industry with independent producers. Currently, our revenues used to give the oil industry incentive are being massively misallocated ‒ we need more support for independent producers willing to explore for additional resources and less support for the three major producers harvesting Prudhoe and Kuparuk.

Finally, there is a natural evolution of an oil-producing region such as the North Slope. Major producers with higher cost structures often build out the initial infrastructure and capture the largest fields in an oil region. Over time, as field economics become more challenging, there is a natural progression to producers with lower cost structures. We should not have a net production tax that discourages this natural evolution and rewards the highest-cost majors for indefinitely harvesting our major legacy fields to fund projects outside of Alaska.

HIGH COSTS OF PRODUCTION

Some suggest we should take less because the cost of production in Alaska is too high. Alaskans should disagree. Alaskans should not take the risks associated with the three major producers’ costs. The major producers are best able to manage their own costs and should bear the risks of not managing them prudently. Further, the three major producers are among the highest cost-producers in the world. Alaskans should not take less due to their inefficient spending.

In addition, the major producers’ claimed costs are not reliable. Their claimed costs have not been audited; they average costs, which shields the true profitability of the low-cost major legacy fields such as Prudhoe and Kuparuk; and their claimed costs include substantial costs that are improper.

Additionally, their claimed costs include excessive and noncompetitive payments to their own profit centers. For example, they deduct the payments to themselves for the transportation of our oil through their pipelines and tankers. These payments to themselves are excessive and noncompetitive. To give one of many possible examples, the Regulatory Commission of Alaska has held that from 1977 through 1996, the major producers over-collected $13.5 billion in excess profits. This entire $13.5 billion in excess profits was claimed as costs of production and improperly deducted from their production taxes. Such excessive and noncompetitive payments by the three majors to themselves should not be deducted from their production taxes. In short, Alaskans need to understand that costs are not always costs, but are often additional profits, when dealing with the three major integrated producers.

BENEFITS OF SB21

Some suggest we should take less because of the benefits of Senate Bill 21, the current tax regime. Some suggest this year SB21 is bringing in $100 million more than ACES, the previous tax regime. Alaskans should disagree.

For different reasons, neither SB21 nor ACES perform well at lower oil prices. Both would have to be significantly modified to realize our fair share under lower oil prices. Further, while ACES brings in a little less than SB21 during periods of lower oil prices, ACES brings in a lot more than SB21 during periods of higher oil prices. Comparing the revenues that would have been generated under SB21 and ACES from 2007 to date reveals ACES would have collected $11 billion more. Essentially, for every $1 more in revenue SB21 is bringing in this year, it will cost us $100 in revenue over time.

Some suggest SB21 has resulted in more production. But SB21 is not the cause of increased production ‒ the gain of a few thousand barrels per day is the result of projects under development for years if not decades before SB21 passed into law.

ALASKANS VOTED

Some suggest we should take less because Alaskans voted not to repeal SB21. Alaskans should disagree. The vote came before the price of oil declined and it became obvious how poorly SB21 performs in periods of lower oil prices.

The vote was also based upon representations of new jobs and substantially increased production. Neither of those representations has proven true. Jobs have substantially declined, and SB21 has had no significant impact on production.

Under SB21, we are forgoing several billion dollars of our fair share in annual revenues to incentivize the three majors to do what they are already legally obligated to do under their leases ‒ develop and produce our oil. Instead, Alaskans should demand they honor their lease commitments. Ironically, we are doing such a poor job of incentivizing additional investment that we would be much better off to simply get our fair share and give all of it back to the oil industry for capital projects in Alaska. This would be much better than allowing billions to simply leave Alaska in the hope the majors will leave some part of our fair share in Alaska.

Finally, we simply cannot do any worse at protecting our interests. If the Legislature is unable to find the political will to pass a reasonable production tax, perhaps it is time for Alaskans to vote again. This vote should be first on Alaskans’ legislators and second on whether to adopt a simple progressive production tax based on our fair share of one-third of the gross market sales.

CONCLUSION

Alaskans need to be clear ‒ there are only three potential sources of revenues to close our massive annual $3.5 billion deficit: 1. three major international producers (through an increased production tax); 2. us (through an income tax, sales tax, user fees, and reduced dividends); or 3. our children (through the Permanent Fund). While we may need some combination of these three sources, Alaskans should be clear that recovering our fair share should be the first place we look, not the last.

Former Gov. Jay Hammond anticipated this dilemma and was also clear that before Alaskans should agree to user fees or a broad-based sales or income tax (much less use the Permanent Fund earnings or dividends), we should first ensure we are recovering one-third of the gross value for our oil. Specifically, he stated, “(F)irst, oil taxes should be adjusted to redeem the State’s initially agreed upon one-third share. Only then should user fees or a broad based sales or income tax be imposed if we lack sufficient revenues to fund essential government services.” Alaskans should agree.