by Joe Paskvan

The lose/lose conundrum advanced by the administration of maintaining either the Alaska Permanent Fund dividend or education, both K-12 and UA, has a solution. Eliminate oil tax credits. Sadly, Alaska is obligated to pay an $8 credit per barrel when the wellhead price is less than $80 per barrel.

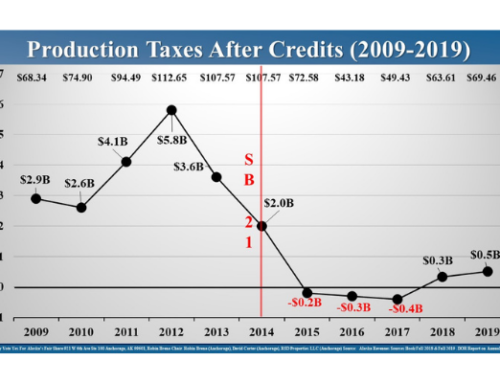

Oil credits obligate Alaska to pay the oil industry billions of dollars without a reciprocal return on Alaska’s investment expenditure. Alaska has not received its Senate Bill 21 promise. There has been no flood of oilfield workers to Alaska’s North Slope, and Alaska’s treasury is not replenished by increased oil production.

The dollar amount of oil credits given away by Alaska is staggering. The 2019 “Per-Taxable-Barrel Credit” is $1.245 billion. Yes, in one year over $1 billion is given away. The forecast credit each year through 2028 is never less than $1 billion for each year. You can look this up yourself by looking at Alaska’s Revenue Source Book Fall 2018, page 106, chapter 8 in the credit section. Alaskans have more to discuss than the lose/lose loss of either PFDs or education. Alaskans should discuss eliminating the oil credit giveaway of billions and billions.

All you need to remember is the SB21 promise in 2014 of 1 million barrels per day oil production; this promise to Alaskans was not kept. For those who quibble about the promised 1 million barrels per day, recall the comparable promise 20 years ago: “No decline after ‘99.”

Whether 20 years ago or by the false SB21 promise, the natural decline of the mature Prudhoe Bay and Kuparuk fields and their satellite fields continues. Please look at page 138, in the appendix, of Alaska’s Revenue Source Book Fall 2018 to see the unfortunate but continuing throughput declines. There is no 1 million barrels per day in Alaska’s forecast future. The promise to Alaskans was an election sham. The consequences of false election promises — the 1 million barrel whopper — can take years to be understood. Alaska now knows the consequences of its oil tax system that pays out billions and billions because of oil credits.

You justly may think that you were not told the truth and that throughput declines would stop under SB21. Additionally, readers should know that developments such as Point Thomson, CD5 and Greater Mooses Tooth and others, including NPRA developments across the Colville River, started before SB21.

The only SB21 trickle down to the residents of Alaska is the lose/lose discussion between current death by loss of the PFD or certain but slow death by loss of education. The solution, at a minimum, is to eliminate SB21 oil credits.

For those who may think the oil bonanza in the Lower 48 such as the Permian Basin in Texas might not be relevant to Alaska, please think about ExxonMobil. ExxonMobil generates more than a 10 percent average return in the Permian Basin, “even at just $35 a barrel.” See Matt Egan Business update March 8. Texas royalties are higher than Alaska royalties; Texas production taxes are higher than Alaska production taxes. The cost of getting Alaska’s crude to the West Coast is less than the greater price obtained for Alaska North Slope West Coast pricing. As of March 7, Alaska’s price for its crude is $67.24 per barrel compared to Texas pricing at $56.66 per barrel. Alaska oil pricing is currently $10 per barrel greater than Texas oil pricing.

ExxonMobil expects by 2024 an 80 percent increase in its Texas Permian oil production. ExxonMobil must not be that interested in its Alaska oil interests competing with its Texas oil interests even though Alaska has higher oil prices. ExxonMobil and other oil companies do not develop Alaska’s oil resources in the best interest of Alaska.

Norway’s $1 trillion sovereign fund is divesting stock ownership of exploration and production oil and gas companies to “reduce the vulnerability of our common wealth to a permanent oil price decline” per Norwegian finance minister Siv Jensen this year. Alaska’s solution should be to get rid of oil credits now.

The time is now to eliminate the billions of oil credit dollars given away with little to nothing received by Alaska.

Alternatively, if you want a simple, straightforward tax system, institute a flat 20 percent production tax with no other calculations needed. This also positions Alaska in the average range/competitive range for cumulative royalty and production tax payments by the oil industry for extraction of Alaska’s owned, taxed and depleting oil resource.