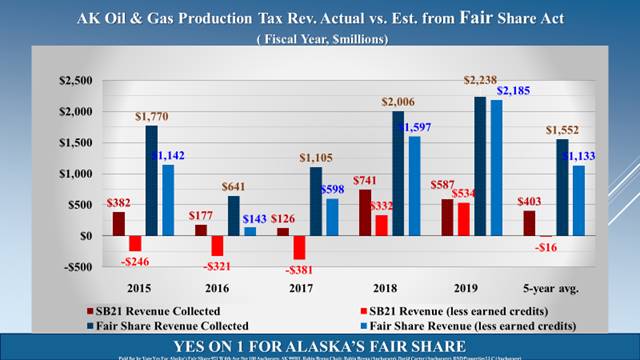

Detailed Modeling Compares Existing Production Taxes with Alaska’s Fair Share Act

Detailed Modeling by Former Tax Director of the Department of Revenue Compares Existing Production Taxes Under Senate Bill 21 with Ballot Measure 1

The comparison reveals the State has paid and owes more in cashable credits than it has received in production taxes under SB21. It also reveals permitting unrelated costs to be deducted from and giving unnecessary $8 per revenue bbl. credits to our major fields significantly and improperly reduce Alaskans’ share of production taxes.

This compares production taxes since SB21 passed (2015-2019) under SB21 and the Fair Share Act with and without cashable credits included. Without cashable credits considered, the five-year average was $403 million under SB21 and $1,552 million under the Fair Share Act or a $1,149 million difference. With cashable credits considered, the five-year average was negative ($16) million under SB21 and $1,133 under the Fair Share Act or a $1,117 million difference.

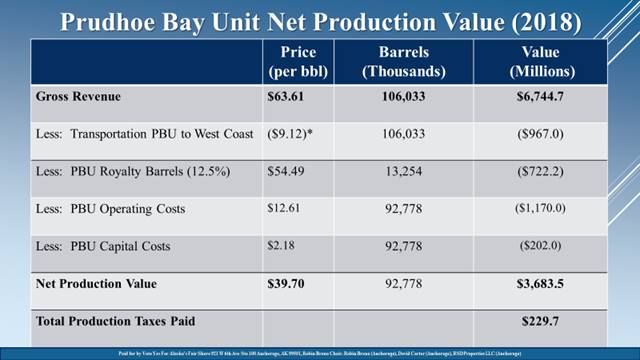

Prudhoe Bay Unit Net Production Value (2018)

This summarizes the six-step order of operations used to calculate production taxes for the Prudhoe Bay Unit (PBU) for 2018 under SB21 and the Fair Share Act. Under SB21, the total production taxes on production from the PBU in 2019 was $229.7 million on net income (net production value) of $3,683.5 million.

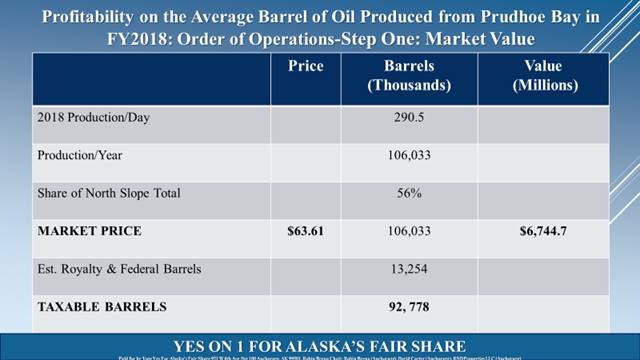

Profitability on the Average Barrel of Oil Produced from Prudhoe Bay in FY 2018

Step 1: Calculation of the Market Value of the ANS crude oil on the West Coast. The Fair Share Act does not amend this calculation, so the calculation is the same under SB21 and the Fair Share Act.

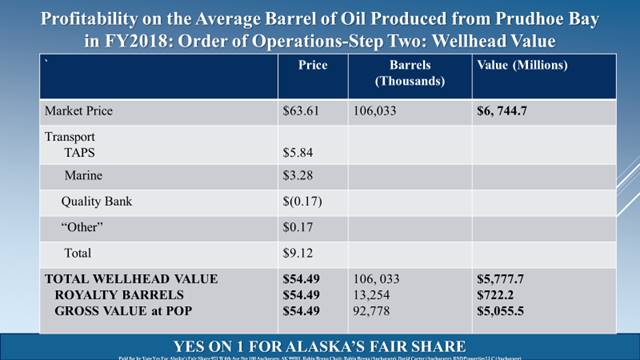

Step 2: Calculation of the wellhead value of ANS for PBU production. West Coast less transportation to the PBU. The market value of royalty barrels ($722.2 million) are deducted from the market value of total barrels ($5777.7 million) to calculate the market value of the revenue barrels ($5,055.5 million). The Fair Share Act does not amend this calculation, so the calculation is the same under SB21 and the Fair Share Act.

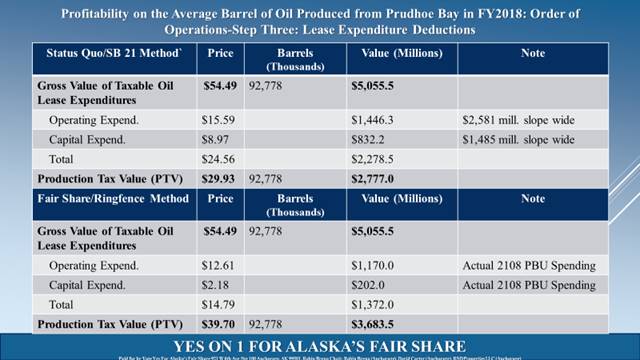

Step 3: Calculation of Production Tax Value. Wellhead value less OPEX and CAPEX for the revenue barrels from the PBU. The Fair Share Act limits deductions from the PBU to costs associated with the PBU, so SB21 deducts ANS average costs while the Fair Share Act deducts actual PBU costs.

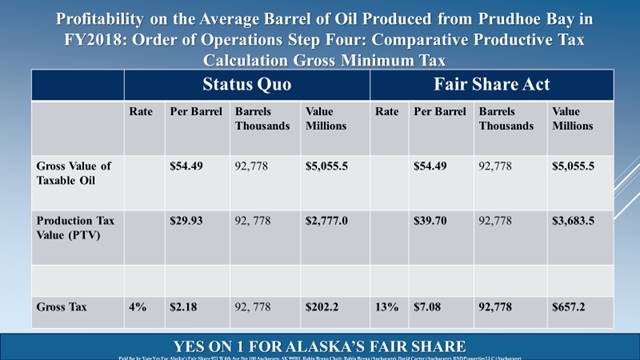

Step 4: Calculation of Gross Minimum Tax under SB21 and the Fair Share Act. The Fair Share Act amends the minimum gross rate when ANS oil is $63.61 from 4% to 13%.

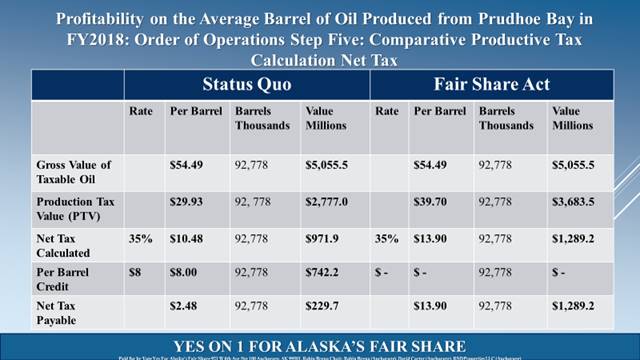

Step 5: Calculation of Net Tax under SB21 and the Fair Share Act. Under SB21, the $8 per revenue barrel credit reduced the production taxes for the PBU by $742.2 million in 2018. The Fair Share Act amends SB21 to eliminate the $8 per revenue barrel credits for production from the PBU.

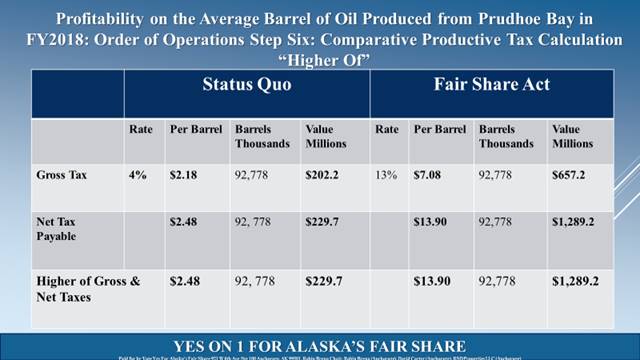

Step 6: Comparison of the calculation of Gross Minimum Tax with Net Tax for SB21 and the Fair Share Act, and the application of “the greater of” the Gross Minimum Calculation or the Net Calculation to determine the production tax due for the PBU in 2018.