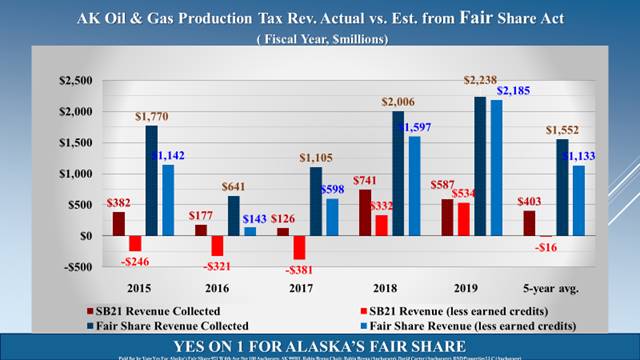

This compares production taxes since SB21 passed (2015-2019) under SB21 and the Fair Share Act with and without cashable credits included. Without cashable credits considered, the five-year average was $403 million under SB21 and $1,552 million under the Fair Share Act or a $1,149 million difference. With cashable credits considered, the five-year average was negative ($16) million under SB21 and $1,133 under the Fair Share Act or a $1,117 million difference.