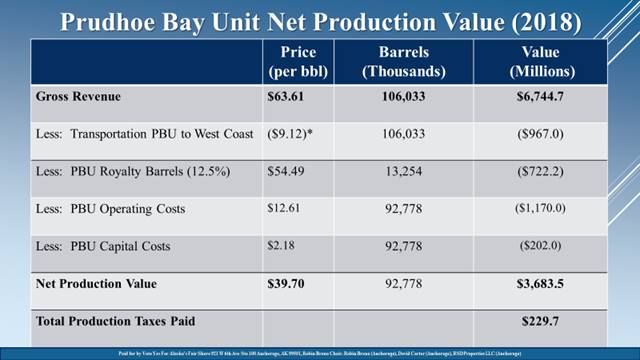

Prudhoe Bay Unit Net Production Value

This summarizes the six-step order of operations used to calculate production taxes for the Prudhoe Bay Unit (PBU) for 2018 under SB21 and the Fair Share Act. Under SB21, the total production taxes on production from the PBU in 2019 was $229.7 million on net income (net production value) of [Read More...]